NZD/USD

The NZD/USD pair fell hard over the course the last week, but as you can see it seems like the market is consolidating in a large area, which of course makes sense as the Federal Reserve moles whether or not it wants to taper off of quantitative easing. It's not a direct path to the New Zealand dollar, but when you think about what quantitative easing could or should do to commodity prices, it makes sense that a commodity currency like the New Zealand dollar simply doesn't know where to go. Obviously, it looks weak overall, but in the end I think that this week will be relatively strong for the Kiwi dollar.

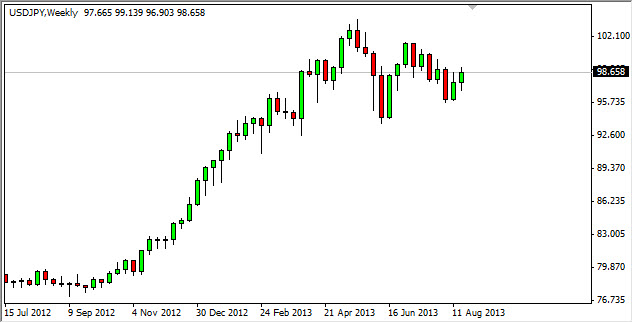

USD/JPY

The USD/JPY pair could be the most important pair going into the future. However, right now the market is simply waiting on Federal Reserve but knowing that the Bank of Japan is working against the value the Yen, and the possibility that the Federal Reserve might start tightening as far as the quantitative easing game is concerned, this market could absolutely skyrocket in value. In fact, if the Federal Reserve does in fact taper off of quantitative easing, I will be buying this pair hand over fist as it should just shoot straight through the roof.

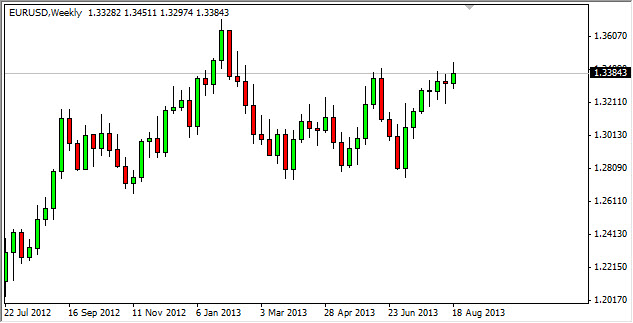

EUR/USD

The EUR/USD try to breakout over the course of the last week, but as you can see the 1.34 level held it away from the upside. That being the case, I think the pair looks like it wants to go higher, but we simply do not have the catalyst yet. If that is what we are looking at, this pair will be very difficult to trade. However, I think that we get a nice pullback that could be another story as it would be an invitation to buy the Euro.

GBP/USD

The GBP/USD pair had an interesting week as we try to crash through the 1.5750 level but failed. In fact, we printed a shooting star which of course is a bearish sign, but we do have the 1.55 handle just below it. It is because of this that I cannot short this pair until we get below the 1.55 handle. If that happens, I think we have 250 pips to the downside before any significant support. On the other hand though, if we managed to break above the 1.5750 level, that would be very bullish indeed.