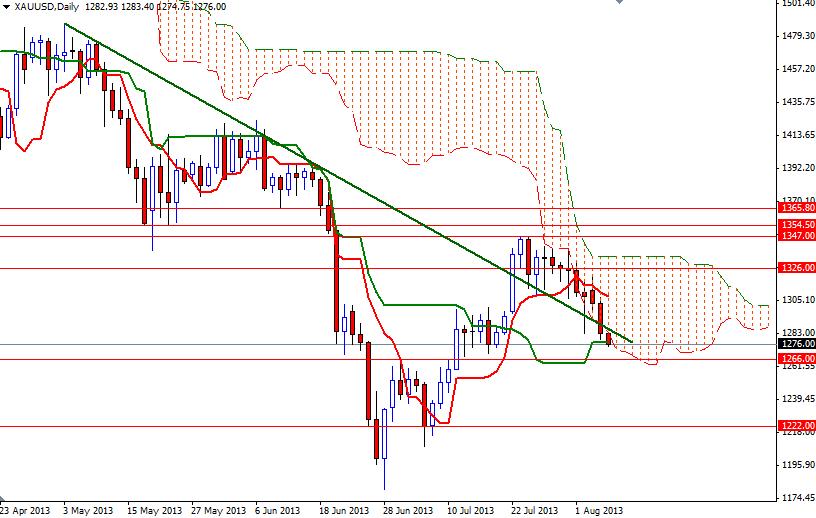

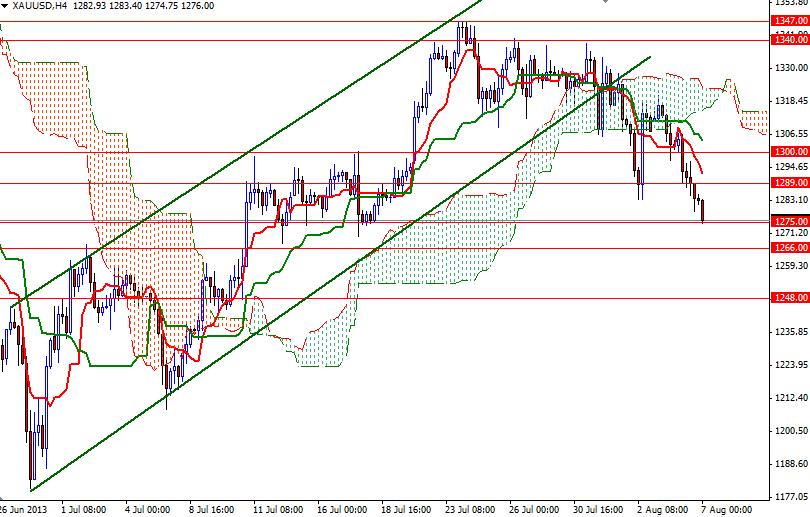

The XAU/USD pair (Gold vs. the Greenback) fell eight days in a row. The pair accelerated its descent on Tuesday after the US trade balance data beat the expectations. According to data from the Commerce Department, the trade deficit shrank to $34.2 billion in June from a revised $44.1 billion in May. It appears that the gold market is ignoring the single disappointing data (last week's official NFP report) and focusing on how a narrowing trade gap will affect the GDP numbers because the faster pace of economic growth means the Federal Reserve is getting closer to scale back its quantitative easing program. At this point there is another thing that we should remember: the FOMC had said “In determining the size, pace, and composition of its asset purchases, the Committee will continue to take appropriate account of the likely efficacy and costs of such purchases as well as the extent of progress toward its economic objectives”. If the Federal Reserve officials are going to trim the current bond-buying program, they are going to do it not just because the economy is improving, but because they are worried about the potential risks and costs of purchases. In yesterday's analysis I had mentioned the importance of the 1300 - 1289 support zone. Not surprisingly, today we reached the first target at 1275. On the daily chart, the XAU/USD pair has been trading below the Ichimoku clouds since December 2012 and I don't think the bearish outlook will change until prices climb above the Ichimoku clouds. We are also trading below the cloud on the 4-hour time frame again, because of that I have no intention of buying gold. However, since the XAU/USD pair paused or reversed in the 1275 - 1266 area during the previous month, it is likely that we will see some support at that point. To the upside, there will be resistance at 1289, 1300 and 1307.16. Only a daily close above the 1320 could ease the selling pressure. If we fall below 1266, there is little to slow down the bears' progression until 1248.

Gold Price Analysis - August 7, 2013

By Alp Kocak

Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

- Labels

- Gold