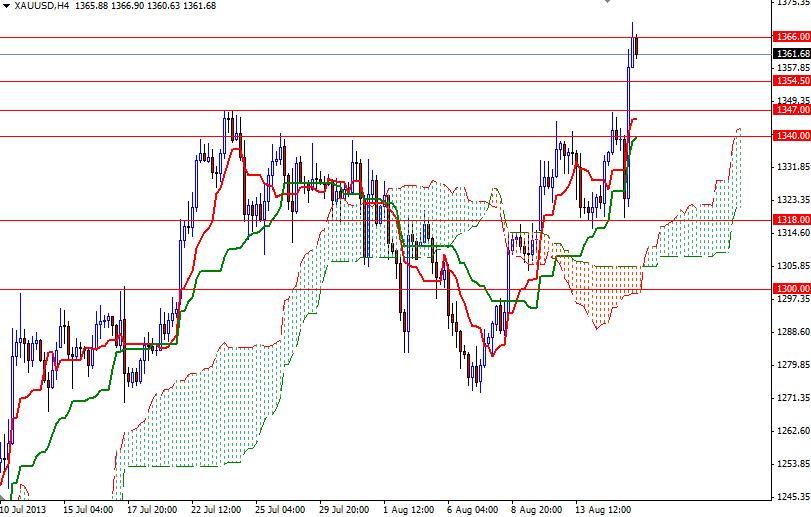

The XAU/USD pair extended its gains after a volatile session as the bulls manage to clear the first important resistance at the 1347 level which had been a cap on the prices since July 23. Gold prices initially pulled back after data from the Labor Department showed that the number of Americans filing applications for jobless benefits declined by 15000 to 320000. Although the pair traded as low as 1318.93, prices reversed after other economic reports came out well below forecasts. Data released from the Federal Reserve Bank of Philadelphia showed that the index measuring manufacturing activity in the region fell to 9.3 in August from 19.8 in July. A similar report from the New York Fed revealed that business conditions index fell to 8.2 from 9.5.

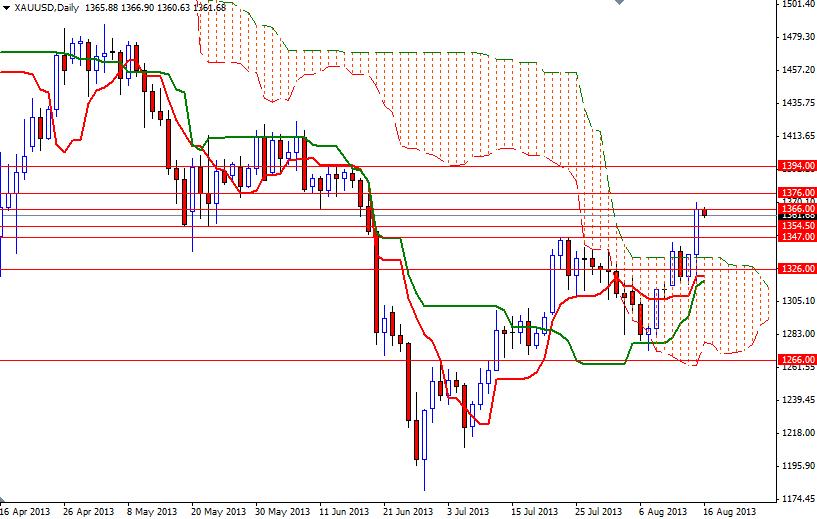

As I mentioned in yesterday's analysis, the pattern on the daily chart suggests that the pair will resume its bullish sentiment as long as the pair continues to trade above the Ichimoku cloud. If the bulls continue to dominate the pair and break through 1366, we might test 1376 and 1394. However, since price usually returns to a (support/resistance) level which it has struggled to break out before continuing the trend so a pull back towards 1354.50 or even 1347 wouldn't be surprising. A daily close below the 1347 level would make me think that the pair will revisit the 1334 level which happens to be the top of the Ichimoku cloud. Today, the market participants will be focusing on housing sector and consumer sentiment data.