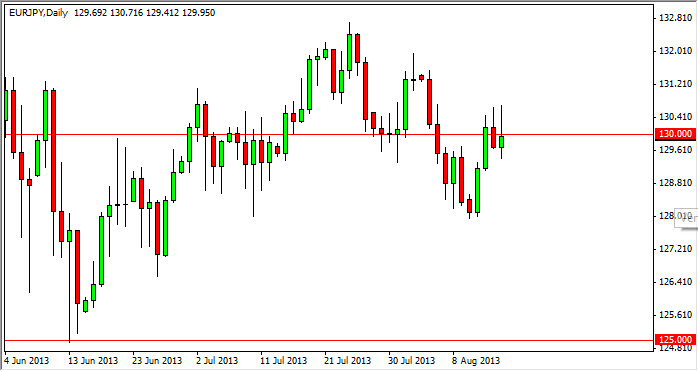

The EUR/JPY pair tried to rally during the session on Thursday, but as you can see gave up quite a bit of the gains above the 130 handle. The shooting star of course is a negative sign, and although I am longer-term positive this market, it does tend to make me a bit nervous when I see candles shaped like this. After all, the 130 level is an obvious "flip" in this market, and a lot of action has been seen around that level.

That being said, I believe that ultimately this candle signals a pullback, not some type of meltdown. The 128 handle should offer support going forward, so that I think it's probably safer to simply wait out the move going down, and buy on signs of support. Alternately, a break above the top of the shooting star is a very bullish sign as well, and because of that I think that there are a lot of positive signs in this chart even though it looks like short term we could see a little bit of selling pressure.

The Euro looks like it's ready to breakout overall.

Looking around the Euro against many other currencies, it does look very strong. After all, the Europeans just exited a recession, which of course is normally good for the currency. Adding to that the fact that the Bank of Japan is more than willing to work against the value of the Yen, you have a nice set up potentially in this marketplace. Fundamentally, it makes sense of this pair to continue to go much higher and I do believe that we will see the 133 level attempted fairly soon. I will be buying supportive candles below, especially at the 128 handle. I also believe that the 125 handle is the "floor" in this marketplace as dictated by the Bank of Japan. If we were to somehow fall below that level, I believe that the central bank would not hesitate to get involved as they have been known to do from time to time recently. Selling is not an option.