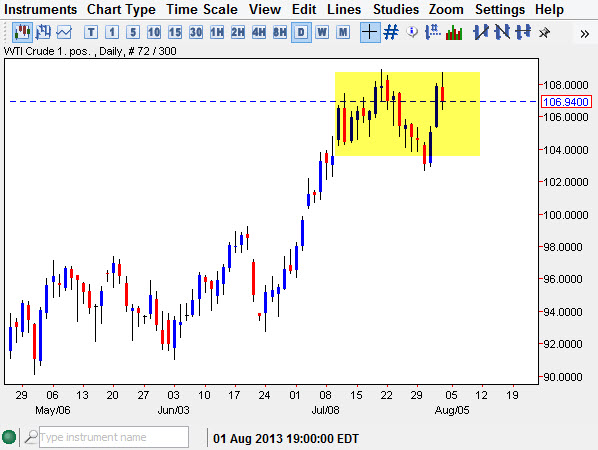

The WTI Crude Oil market and try to rally during the session on Friday, but as you can see the $109 level has offered resistance yet again. This drove prices back down and we ended up forming a shooting star for the session that closed just below the $107 handle. Because of this, it appears of this market is grinding sideways again, and that we should begin to fall and try to test the bottom of the range at the $103 level. If that's the case, then expect to see a short-term selling opportunity in this market, but right now this market is without a doubt a very dangerous one to play consider how volatile and headline driven it is.

Not all headlines affect this market, but certainly the situation in Egypt and the Federal Reserve are the main drivers at the moment. This isn't necessarily in reaction to oil, but rather the free flow of it in the Suez Canal. The Federal Reserve of course has an effect on the value the US dollar, which of course is typically inverse of this chart. That being said, it appears this market is going to find a little bit of weakness, and you have to keep in mind that even above the shooting star there is the $110 level which should be rather resistive as well based upon the large round psychologically significant aspect of that number.

Pause

We could simply be taken to a positive after a fairly parabolic move, after all that's a fairly common way for charts to resolve larger moves. If that's the case, that a move above 110 it should signify much higher pricing, probably $115 before it's all said and done. As far as selling is concerned, I would do it on a short-term basis here, but I would not be risking a whole lot of money. Perhaps using the options market would be the way to go as it limits your risks well before you place your money. CFD markets could also work as well, because you can adjust the position size accordingly to fit the volatility.