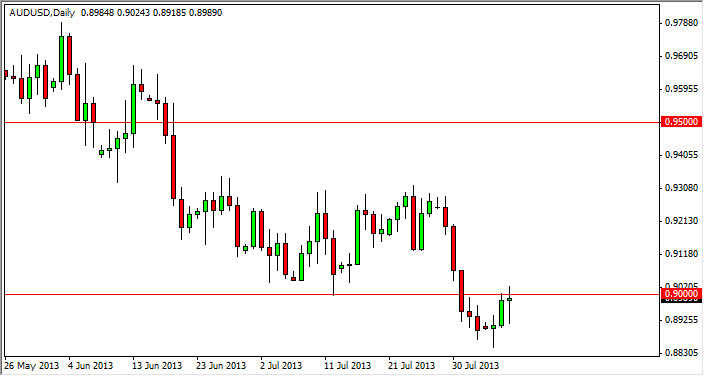

The Australian dollar has been one of the weakest G 10 currencies in the world for several months now. As a result, it's not a surprise that we are still below the 0.90 handle. This is an area of significant support, and although we did get a bit of a bounce during the session and have formed a hammer in this general vicinity, I am not comfortable going long the Aussie at this point time.

The biggest problem with the Australian dollar is that it's highly leveraged to the Asian economy, and as a result it is highly dependent on Asians importing raw materials from the mining sector as well as many others. That being the case, you have to pay attention to what's going on in Asia to understand what's going on in Australia.

China is the key

The Chinese economy will be crucial in deciding where the Australian dollar goes next. However, from a technical point of view I see resistance all the way up to the 0.93 handle, and as a result I think it's actually good news if this pair looks to be getting ready to bounce as it should give us the opportunity to sell at a higher level.

I expect the Aussie to really struggle above here, and the higher it goes, the more interested I am in selling it. That being the case, I think that the rally is going to actually be a very good thing for me in the long-term. I believe that the Australian dollar will continue lower, based upon several different factors. Looking at the charts, I can make a serious argument for this pair hitting the 0.85 handle, and as a result we could see this pair really begin to fall apart.

Pay attention to the gold markets as well, as they do tend to have a pretty serious effect on the Australian dollar also.That being the case, you should pay attention to the fact that the gold market simply cannot get above the $1350 level. With that being obvious, I still believe that the Aussie is one of the best shorts out there, but we may need larger firms to come back online after summer break in order to see big moves.