EUR/USD

The EUR/USD pair had another positive week over the last five sessions, but I am still a bit worried about the bullishness. After all, you can see on the chart that there is a descending triangle being formed in this market, and a breakdown would send this pair much lower. With it being the dead of summer at the moment, I suspect that the next serious move is several weeks away, probably lining up with the possible tapering off of quantitative easing by the Fed in September.

At that point, we will have greater liquidity, and possibly more clarity out of the Fed, which seems 50-50 on just about anything these days. I think that a break above the downtrend line on the chart sends this pair into a true uptrend. On the other hand, if we end up breaking below the 1.28 level – we could go back to 1.20 or so again. This fall should be interesting.

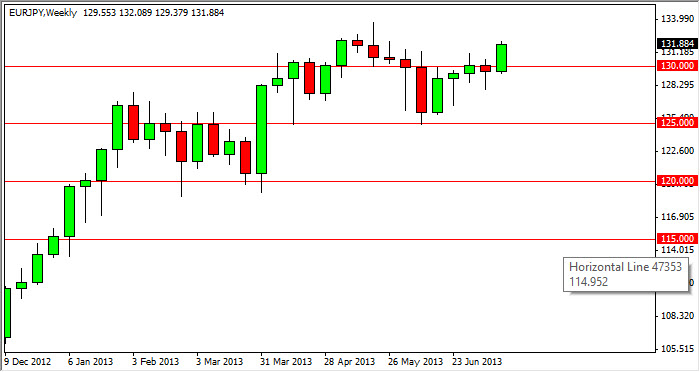

EUR/JPY

The EUR/JPY pair rose during the previous week as the Yen continues to get beaten up in general. The EUR/JPY could be especially interesting as the Euro seems to be reaching an inflection point in general. (See the EUR/USD analysis.) The market broke the top of a weekly hammer in the last couple of days, and because of this – it looks as if the market is going much higher now.

This doesn’t mean that it won’t pull back from time to time, but in general – this market looks like it wants to try and reach 134 as far as I can tell. I suspect that the 130 level is now a significant support.

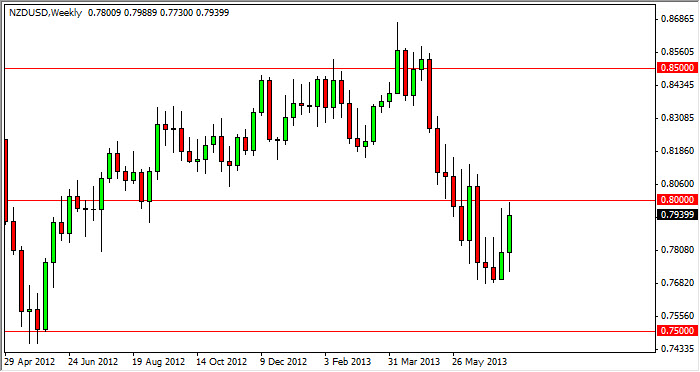

NZD/USD

The NZD/USD pair gained during the last week, but you can see that the 0.80 level kept the buyers at bay in the end. This suggests to me that the pair is going to struggle going forward, and the Friday candle being a shooting star certainly suggests that as well. The pair will continue to be hampered by the lack of demand for some commodities, and because of this – I expect trouble for commodity currencies in general. The Kiwi has outperformed its cousin the Aussie lately, but both are weak.

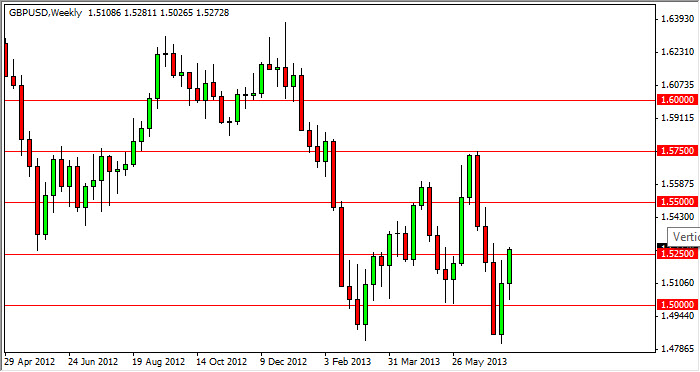

GBP/USD

The GBP/USD pair rose over the last five sessions and cleared the 1.5250 level on the close. This of course is a positive sign, and as a result I think this pair is going higher, at least for the shorter-term. I think the 1.55 level will be targeted, and that there will be significant resistance to be found there. While I am not a fan of the Pound in general, I don’t think I will be shorting this pair anytime soon.