EUR/USD

The EUR/USD pair had a positive showing this past week, but quite frankly you can see that there is a potential in the ascending triangle forming now. The red line on the chart is a weekly downtrend line, and it has become obvious now that the 1.28 level is significant support. With that being the case, I am simply look at this chart as one that's more than likely going to offer a short-term buying opportunity, only to turn around and offer a little bit longer term selling opportunity. As is normally the case, this market is a complete mess.

AUD/USD

If there was ever an ugly chart, this is it. The Australian dollar tried to rally during the previous week, but as you can see we formed a significant shooting star the bottom of an even more significant drop. This market just looks like it wants to break down below the 0.90 handle, and when it does we will more than likely have an open shot down to the 0.85 handle relatively soon. This doesn't mean we can't rally, and quite frankly I would prefer to see that - because it will allow me to sell the Australian dollar at a higher level.

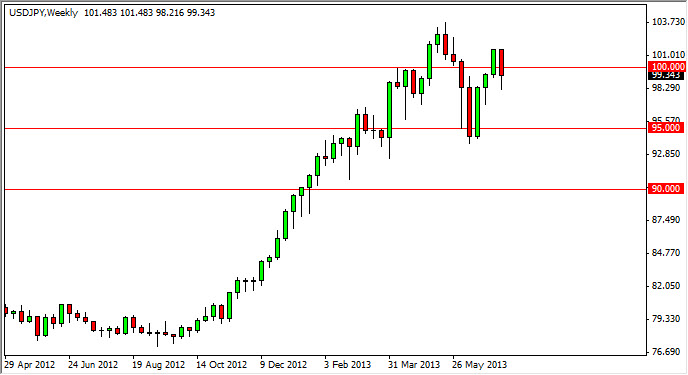

USD/JPY

The USD/JPY pair fell during the balance of the week as well, but as you can see we found a little bit of support in the vicinity of the 99 handle. A lot of this would've been a reaction to the Federal Reserve minutes being released on Wednesday showing several of the members of the committee being concerned about the employment levels in America. This had part of the market worrying about whether or not the Federal Reserve is going to taper off of quantitative easing in September or not, but quite frankly the Bank of Japan will make sure this pair continues to rise. This is going to be a buying opportunity.

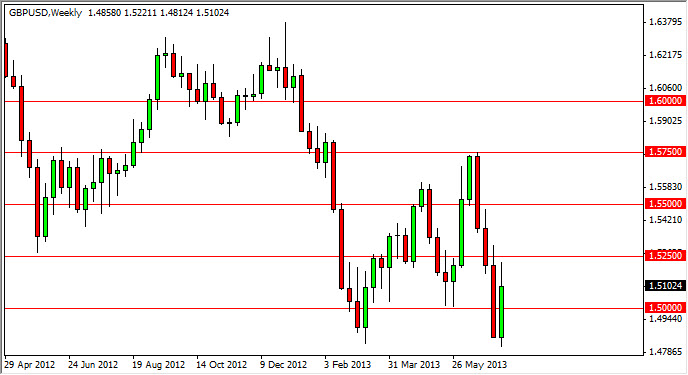

GBP/USD

The GBP/USD pair had a very strong showing over the last five sessions, but failed at the 1.5250 level, an area that I have been watching quite seriously. In fact, the Friday session was weak enough that we managed to close at roughly 1.51 for the week. I think this pair will continue lower, and as a result I am selling on the shorter-term charts, but would become even more aggressively short of this market if we can get below the 1.50 handle.