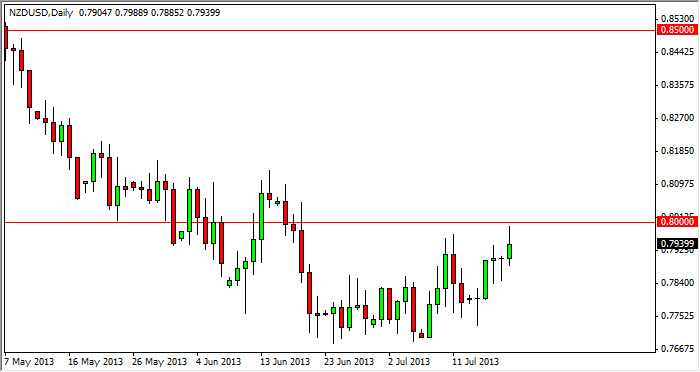

The NZD/USD pair rose during the session on Friday, but as you can see it found plenty of trouble at the 0.80 handle. This is an area that I suspected would be a bit of trouble for the buyers, and that's exactly what happened. The candle is shaped like a shooting star, and as a result this confirms what I thought about this area, but what I am concerned about as far as selling right now is the fact that there are two hammers in front of that candle. In other words, this market looks very confused at the moment, but I have to believe that the longer-term downtrend will eventually win out.

The New Zealand dollar has been a little bit more resilient than it antipodean cousin across the Tasman, the Aussie dollar. Both of these tend to run on commodity prices, but the Australian dollar is tied to gold a bit more which of course you know has been absolutely pummeled over the last couple of months. Nonetheless though, both of these currencies tend to move in lockstep over the longer term, and therefore I am also looking at the Australian dollar as an indicator to whether or not there should be strength in this market.

0.82 needs to be overcome in order for me to get bullish

It isn't until we clear the 0.82 handle on the daily chart that I feel comfortable going long of this market. This is simply because the trend is been so strong, and the 0.80 level should have been much more difficult to break down below. That being the case, keep an eye on the Australian dollar as well, and the 0.90 handle. If that level gets violated, I have a hard time believing that the Kiwi dollar will move lower in sympathy if nothing else.

I believe that the next 250 pips offer plenty of resistance, and therefore I'm not interested in buying at this point. Quite rightly, I could see this market moving a little higher based upon the couple of hammers, but in the end I think the sellers will flex their muscles.