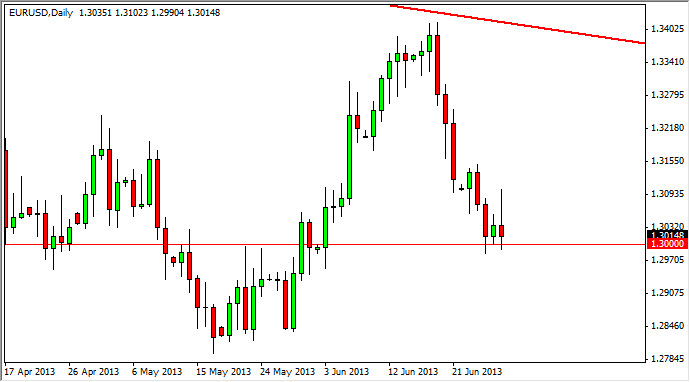

The EUR/USD pair rallied during most of the session on Friday, but as you can see gave up a lot of the gains at the 1.31 handle. The 1.31 handle running enough sellers to push his pair down and form a shooting star for the session, which of course shows weakness. On top of that, it is of the bottom of a down move, which means that the rally completely fell during the session.

The biggest problem right now though is the fact that the 1.30 level does offer quite a bit of support. This is a shooting star sitting on top of support, which of course to me signifies a situation where nobody is going to win this fight. Expect a lot of choppiness, and general confusion in this pair. On the other hand, if we did rally above the 1.31 handle this would be very bullish sign as we broke out above that resistance level that was so difficult on Friday.

I still think rallies are imitations to sell

The situation in Europe is starting get ugly again, as the stock markets have shown the last several weeks. On top of that, restarting the see bond yields blowout again in some of the peripheral countries, and this of course will drive money out of Europe. However, there is still a lot technical support below, so quite frankly I would rather see a rally that shows weakness a little closer to the 1.32 level, an area that has been resistant previously, going back to the month of April.

If we get that move, I would not hesitate at all to start selling as I do think that this market will continue lower. This is even a matter of "risk on, risk off", but rather a cure play on which economy is doing better. For once, this pair isn't following the stock markets, but it is simply following where economic growth is seen. That being the case, I do expect this pair to continue lower, but it needs to get some type of bounce in order to collect more sellers.