By: Alan Edwards

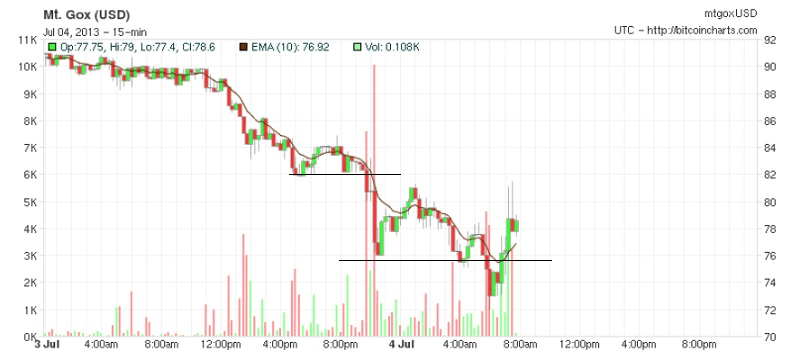

The above BTC_USD candles over the last few days you can see that there are resistance floors and ceilings being established which when broken through lead to breakouts, classic FOREX behavior that would be attractive to FIAT traders.

So should you trade?

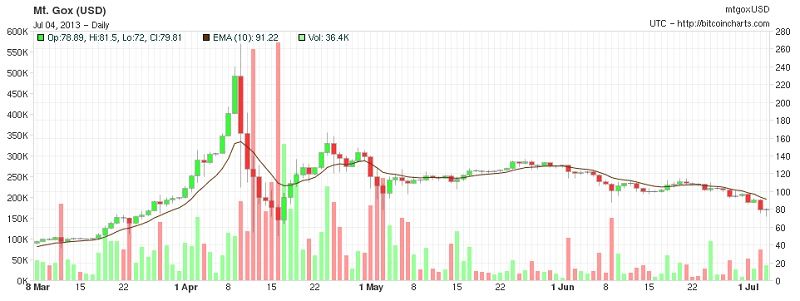

Charts show the BTC_USD cross hitting a 10 week low at the time of righting and looks to be a good time to consider going into the Bitcoin market by after a breakout confirmation indicator signal or a momentum change indicator signal. Unfortunately at present there are still a number of interrelated problems which make this the attractive trading opportunity not as attractive as it appears to be.

The life cycle of a purchase of a Bitcoin is still very slow relative to FIAT since it requires a confirmation process to occur between two addresses which even a broker must abide by. The result is that trade confirmation time periods can never be guaranteed so you will have to enter your trade with quite a large margin of error which makes particularly if you are leveraging your trade. None of the Bitcoin Brokers have the sophisticated event handling to handle price change events around the Bitcoin confirmation process. The straight through processing that allows brokers to instantaneously buy from liquidity providers is simply not available and similarly they cannot reliably manage their risk instantaneously by going into the market when they need to. Any Bitcoin FOREX broker who tried to reduce that time horizon artificially to mimic the FIAT Currency trading experience would have to include a higher spread to cover the risk premium. At the present time none of the major brokers are offering Bitcoin and I suspect for these very same reasons. There are a number of niche firms out there trying to solve these problems but still lack the quality of end to end trading experience of current FIAT FOREX brokers.

As I mentioned in a previous Bulletin the only system of serious leverage trading advisable would be to use an established spread betting company which would mean having to make the trade relying on a narrow range of binary trading products they offer. While this initially appears attractive leveraging Bitcoin/FIAT crosses against such pay-off conditions based is high risk at best. It’s essentially an uncovered leveraged position since it cannot be accurately hedged due to its underlying structure and the limited products available. You would not find city traders trading such instruments (at work) nor would they be allowed, at least with spot trading you can limit your risk exposure either using your charting software or a robot. I would therefore suggest taking a small unleveraged punt once the momentum ticks for the experience of trading Bitoin but serious Bitcoin FOREX Trading on such an opportunity is still a while off.

News Round Up

There continues to be further ups and downs between FIAT Regulators and Bitcoin enterprises as they try to find common ground particularly in the US. The Department of Financial Institutions (DFI) in California recently sent a cease and desist notice to the Bitcoin Foundation in what seems another heavy handed and unlawful attempt to undermine the legitimacy and growth of Bitcoin. As I have explained before here this is a symptom of risk they might lose their reserve status if the popularity of virtual currencies continues. Fortunately the problems are mostly in the US with European regulators appearing to be more cautious than adversarial. The real underlying cause of concern for consumers, business and FOREX Traders is not the need for regulation but there is a whole new legal framework to be created and until it exists there are going to be teething problems.

In other news the #BTCLondon, a VC event organised by CoinDesk passed quiet quietly here in London, personally I thought when the event was announced a few months ago there would have been more of a buzz around the event and expected a market bounce, there was little buzz and the BTC price as you can see is at a 10 week low. This is probably is due to the inclusivity of the event which was invite only for business that goes against the grain a bit of Bitcoin and explains the lack of exposure. This is part of a pattern that has many Bitcoiners pioneers concerned about the direction of Bitcoin under the Bitcoin Foundation and allegations of a lack of independence between the Foundation and the companies that fund it. The Winklevoss twins this week announced the creation of an investment vehicle to allow investors to access Bitcoin price rises without having to worry about the safety, technical and seemingly legal problems that go with them. Since they own a large number of Bitcoins it appears this is their way of getting a return on their investment without the disadvantages of shorting a large percentage of the Bitcoin currency.

Alan Edwards is a financial engineer with 15 years experience working in the city of London. He is the founder and lead quant strategist of Spotz.com, a Bitcoin Risk financial services company specializing in security, risk management and investment.