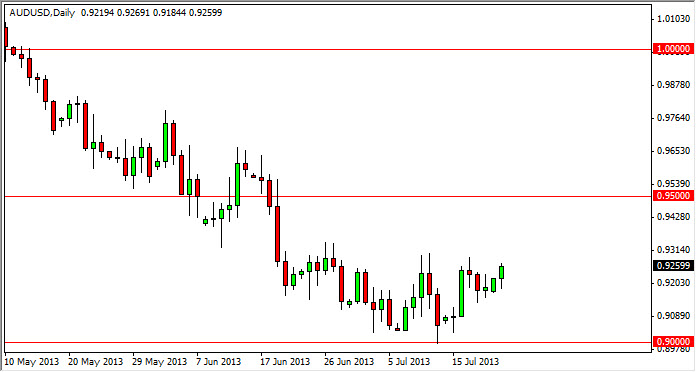

The AUD/USD market fell initially during the session on Monday, but as you can also see rose during the end of the session, in order to form some type of hammer. This market looks like it's trying to breakout above the 0.93 level, but quite frankly I'm not interested in this market simply because there is a ton of resistance between here and the 0.97 handle. In fact, I think that this market needs to get above that level in order for me to even seriously consider buying it.

When you look at the pair, you can see that the 0.95 level should be an area of resistance as well. Because of that, I think that the prudent trader will simply wait for some type of resistive candle to start selling the Australian dollar yet again. What I found interesting during the Monday session is the fact that gold skyrocketed, but the Aussie dollar was fairly weak in its rally. It did gain, but really not much, and certainly not impressively.

Simply biding my time, looking to sell

Going forward, I am looking for some type of resistive candle in this general vicinity, or closer to the 0.95 level in order to start selling the Australian dollar again. The fact that gold rose during the session and the Australian dollar did not, tells me that there is something wrong with the Australian dollar itself. This obviously wasn't a matter of gold weighing upon the pair, but perhaps a reflection on the Australian economy or perhaps even some of the Asian economies that the Australians provide raw materials for. The cousin of this, we think that this market will continue to be weak, and eventually the 0.90 level will be broken down below. If that happens, fully expect this market to come undone and the Australian dollar to lose massive amounts of value. However, in the meantime we have to simply wait for the pullback in order to start selling yet again.