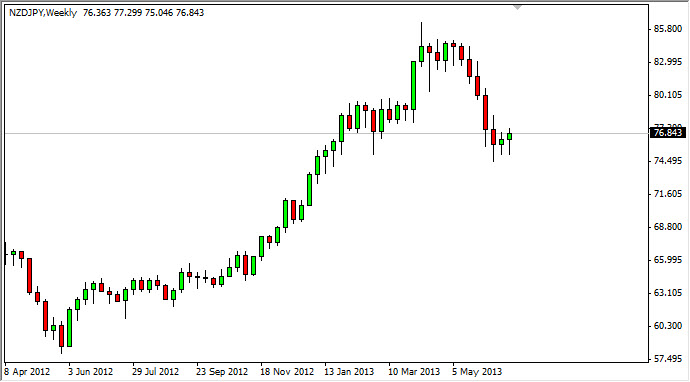

EUR/USD

The EUR/USD pair fell over the course of the last week, but found the 1.30 level as being supportive. The pair has bounced off of this level several times in the past, and because of this I think this pair will continue to be choppy, and therefore almost impossible for the longer-term trader to bother with. The pair has significant support down to the 1.28 level, and as a result I am avoiding anything more than a short-term trade at this point.

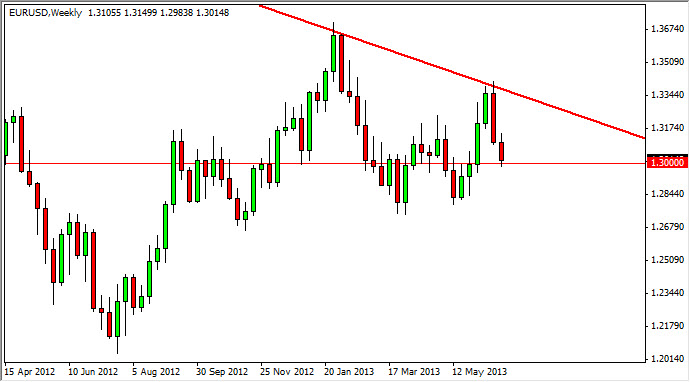

EUR/JPY

The EUR/JPY pair fell over the majority of the week, but bounced in the end to form a significant looking hammer. The candle stopped just short of breaking out above the 130 level, but in the end it still looks like the pair will more than likely continue higher as the Yen sells off in general. This will be helped by the USD/JPY pair as well, and the fact that the Euro is sitting on top of support against the Dollar doesn’t exactly hurt bullish moves in this pair either. However, there is a significant amount of resistance just above – but in the end the 131 level will be taken out, and then the 133 level. I believe this pair goes to 135 in the end.

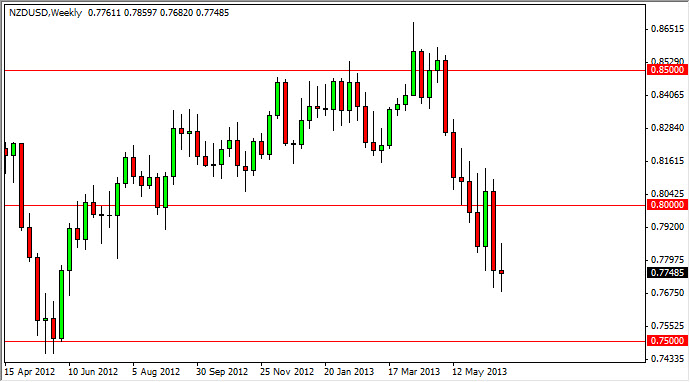

NZD/USD

The NZD/USD pair went back and forth during the week, essentially ending the week flat. The market still looks as if it wants to fall, and the breaking of the bottom of this candle should send this pair down to the 0.75 level. The commodity markets continue to struggle, and this will more than likely push this pair down as the US dollar continues to reign supreme.

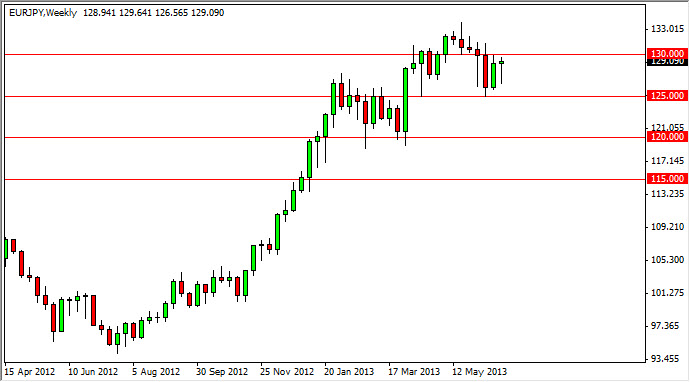

NZD/JPY

The NZD/JPY pair shows a hammer for the second week in a row, and with a bit of imagination – you could even call the third candle from the left a hammer as well. With the various XXX/JPY pairs all looking ready to break out, this pair could follow suit. However, remember that the NZD is highly leveraged to commodity markets. It is because of this that it might trail the USD/JPY, EUR/JPY, and GBP/JPY pairs.