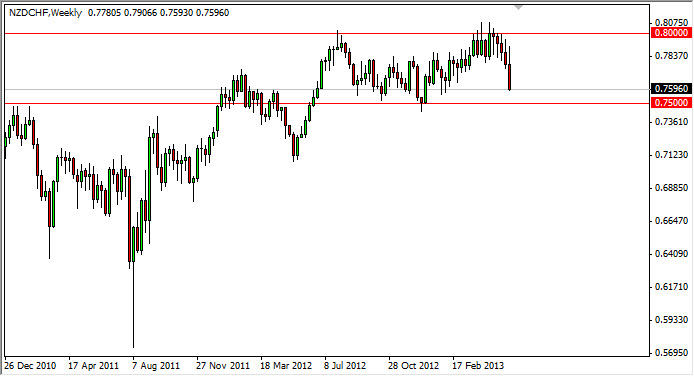

EUR/USD

I still see this market as being in consolidation, and a bit too tight for longer-term charts to be used effectively by traders. The market is roughly 400 pips at the moment, between the 1.28 level and the 1.32 level. The market fell during the majority of the previous week, but you can see that the bottom of the consolidation area offered enough support in order to bounce and form a hammer. The 1.30 level was broken, but when we sold off on Friday – we managed to retake the 1.30 handle, suggesting to me that we are going to make a run towards the 1.32 level.

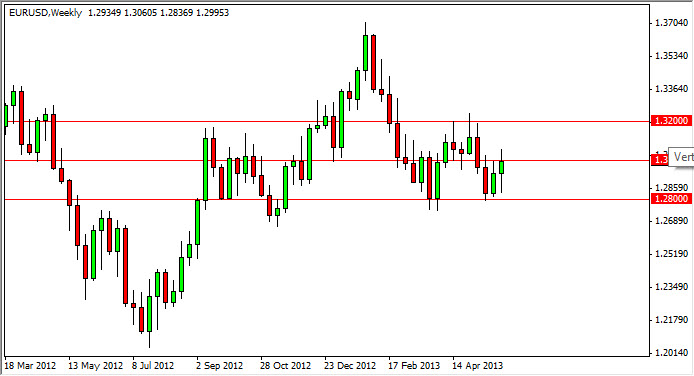

AUD/USD

The AUD/USD pair sold off during the week, breaking below the 0.9650 level. The area was a massive support area in the past, and as a result the market selling off below this area does in fact matter to the market. The breaking below this area signifies the market is ready to try and take out the 0.95 level. The braking of that level sends us down to the 0.90 level in my opinion as well. The fact that the Reserve Bank of Australia is meeting on Tuesday could play a major factor in this pair as well.

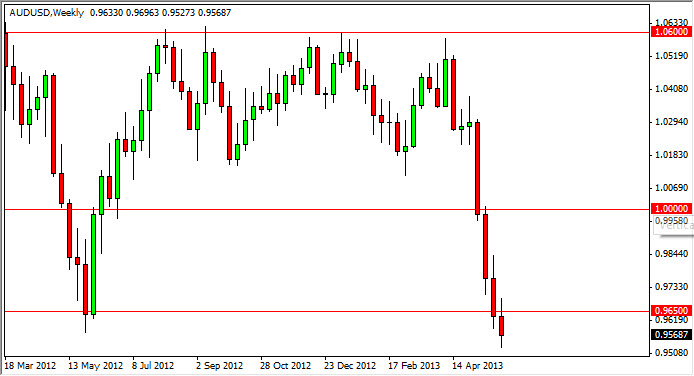

GBP/USD

The GBP/USD pair fell during the week, but found support at the 1.50 level for the second week in a row. The hammer that formed for the week suggests that the market is trying to find a bit of legs going forward. However, the top of the hammer is just below the 1.5250 level, and I believe that the market will have to break that level in order to continue higher and to the 1.55 level.

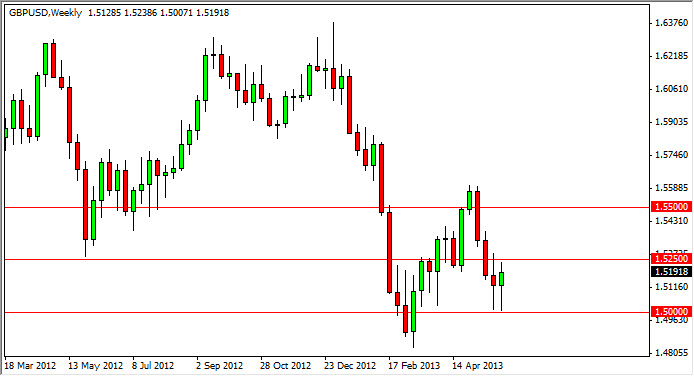

NZD/CHF

The NZD/CHF pair fell drastically during the week, as the Kiwi dollar got beat up rather drastically. The market represents the “risk appetite” of the markets as a whole, and it looks like there would have been a bit of fear creeping in based upon the price action. A break of the 0.75 level will more than likely mean that a lot of bad news is suddenly being focused on.

The 0.75 level could of course offer support though, and as a result this would keep the pair, and therefore the risk appetite of the world’s markets will remain status quo.