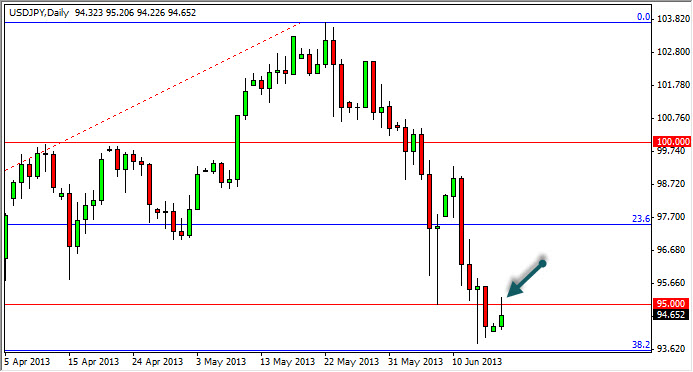

The USD/JPY pair attempted to rally during the session on Monday, but as you can see the 95 handle has offered enough resistance to push prices back down. Because of this, the market formed a shooting star, which of course is a very good sign. We have dipped below the 95 handle, and now it appears that we are simply trying to test it as resistance. By the look of things, it appears that he did in fact pass that test.

The biggest problem with his pair of course comes in the form of three major things: the Nikkei, the Bank of Japan, and the Federal Reserve. With that being the case, the Japanese yen has been one of the most volatile trading currencies over the last couple of months.

The Nikkei should be watched for signs of risk aversion, or risk-taking in Japan itself. The Bank of Japan of course once a lower valued Yen, and although it hasn't said anything yet, I have a belief that this market is going to cause them to start to jawbone the value of the Yen lower. However, they will probably wait until after Wednesday when the FMOC meeting concludes. The Federal Reserve of course could move this pair by itself, and if it suggests that tapering is coming sooner rather than later as far as quantitative easing is concerned, this pair will skyrocket long before the Japanese wake-up.

If the Federal Reserve Chairman doesn't come through….

If Mr. Bernanke doesn't move the Dollar higher against the Yen by his statements, we could very well see the Bank of Japan start to speak openly about the value of the Yen. If we get to the 90 handle, I believe that that point in time the Bank of Japan will enter the market and intervene against the value of the Yen. This is because that would've been far too large of a drop in far too short of amount of time for their liking based upon historical actions. Going forward, I do expect to be buying this pair soon, but probably not for the next couple of days.