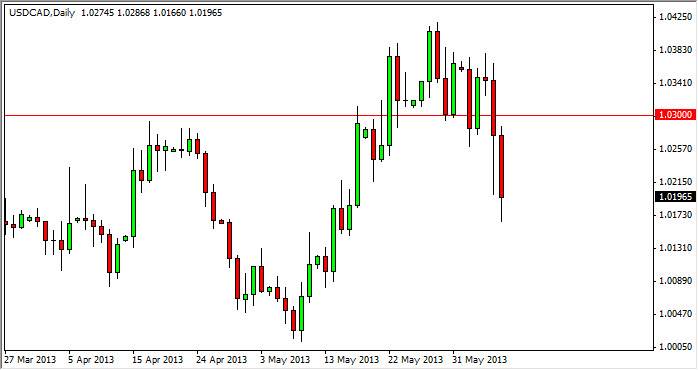

The USD/CAD pair fell during the Friday session after the nonfarm payroll numbers came out, and smashed into the 1.02 level. Within this chart, I cannot help but think that the US dollar may be on it back foot against the Canadian dollar, but I have also maintained that the 1.02 area is vital for the buyers to maintain.

I believe that the oil markets will be important with that direction of that market moving the direction of this market as usual. It should be noted that the oil markets had a strong showing during the session on Friday, and as a result the Canadian dollar of course gained. But it should also be stated that the oil markets are closing in on significant resistance, and this of course could put downward pressure and that market which of course will typically run in verse to this one. As that market falls, this market should rise.

Monday should be important

I believe that the Monday close should be vital for the future direction of this pair. If we managed to close below the lows of the Friday candle, I see no reason why we can head towards the parity level. On the other hand, if we close well above the 1.02 level, I can see that we will run to the 1.03 area, and possibly even the 1.04 level. Above there, I see this market going to 1.10 before it's all said and done.

However, a much more likely scenario is that we enter a tight trading range for the short term. After all, we are starting to head into the summer months, and that typically means range bound trading in most markets. These two economies are highly intertwined, so it makes sense that a lot of confusion would be found between the two currencies. Looking forward, I eventually think that this pair will take off to the upside, simply because United States is doing so much better than most other countries. The Canadian jobs number, although decent for Friday, wasn't necessarily a blowout number either.