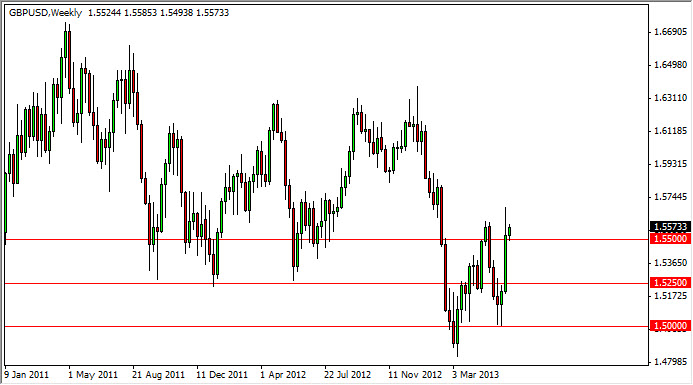

GBP/USD

The GBP/USD pair had spent most of the second quarter of 2013 stuck between the 1.55 and the 1.50 levels. Towards the beginning of June, we did see a massive breakout though, which of course was very bullish for Britain. However, there is so much noise above that it is very difficult to imagine that the move during the third quarter for this year will be as equally smooth. Although I do firmly believe that this market is going higher, I think that it will be a real struggle to get above the 1.60 handle during the third quarter, simply because of all of the "noise" between the 1.55 area and the 1.60 handle. Expect bullishness, but also expect to see a lot of choppiness.

EUR/JPY

The EUR/JPY pair has been absolutely parabolic for the longest time. However, when you look at this chart you can see that there is aptly no reason to short this pair, and there is even an argument to be made for a massive bullish flag that we have broken out of at the 125 handle. If this flag does turn out to be true, this market is going to the 150 handle, which of course is quite a ways higher from where the chart currently shows the market being. Because of this, I am very bullish of this pair, and will continue to be going forward. I see absolutely no reason why we don't continue the bullishness, not only for the third quarter, but for several years to come.

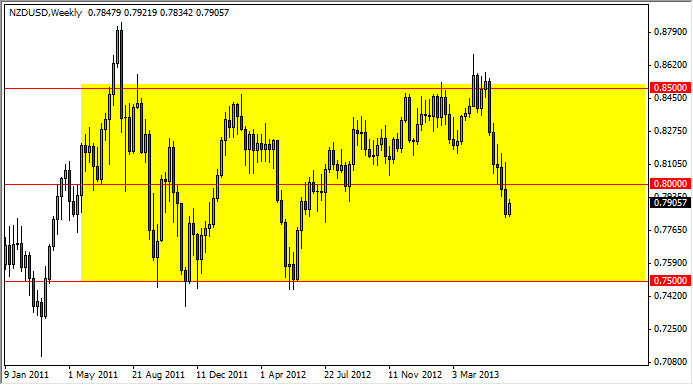

NZD/USD

The NZD/USD got hit really hard in late May, and continued through the month of June to simply fall apart. Looking at this chart, it's easy to recognize that there is a consolidation area between the 0.75 handle on the bottom, and the 0.85 handle on the top. Because of the break down below the 0.80 handle, I am relatively confident that this market will continue to see weakness going forward, and that the selloff in the commodity markets will not help the New Zealand dollar. The only real question is whether or not the selloff reaches the 0.75 handle before you read this for the third quarter? I don't expect a break down below that level, and I also would expect to see a bit of support down there in order to bounce back towards the 0.80 handle. This consolidation goes all the way back to roughly February of 2011, and there is nothing on this chart that suggests that will continue to be sideways going in a roughly 1000 pip range.

EUR/USD

The pair will be a little bit more difficult to get a handle on, simply because there have been so many different crosswinds involving it. We have recently seen a bit of bullishness in favor of the Euro, and as a result I fully expect to see strength going forward. The biggest question of course is whether or not the big trend line can be broken above. I believe that the 1.35 level will be very resistive, but if we can get above that we could return to the "strong Euro, weak Dollar" type of market. However, there has been very little done to address the actual underlying issues in Europe, so I have this sneaking suspicion that the headlines will turn negative again relatively soon. Expect extreme amounts of volatility, and quite frankly until we get above the 1.35 handle, I would not be willing to hang onto any trade in this pair for more than a day or two.