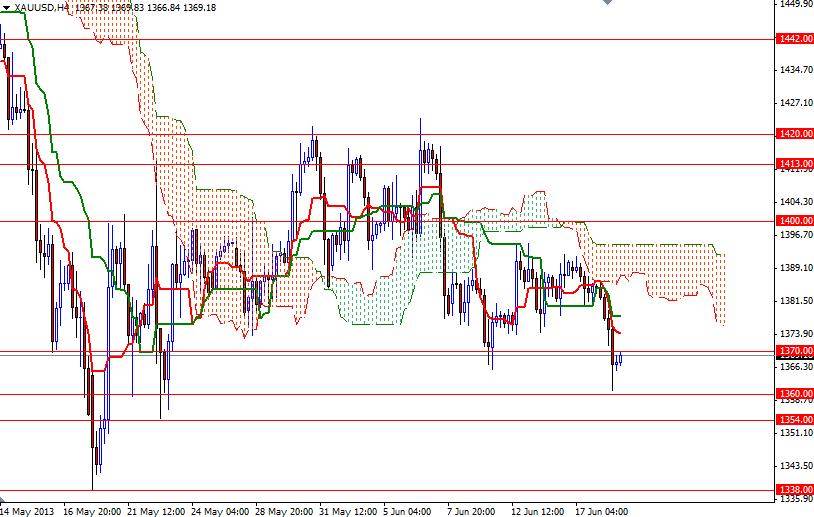

The American dollar continued to gain ground against gold during yesterday's session on growing expectations that the Federal Reserve will provide more information about the timeline for scaling back its monthly asset purchases. The XAU/USD pair has been under heavy selling pressure since it broke below the 1532 level -which held the market for more than 80 weeks- in April. At their previous meetings, Federal Open Market Committee members had said that the stimulus could be reduced in coming months if economic improvement continued. Market players think that the U.S. economy is steadily recovering, and the Federal Reserve is now considering an exit strategy in order to start lowering the stimulus package. Since market sentiment is ultimately driven by expectations of tapering, the bears are taking advantage of it. Yesterday, the XAU/USD pair broke below the support level of 1370 and traded as low as 1361.06. From a technical perspective, I expect gold prices to continue its descent while we are trading below the Ichimoku clouds.

Today, I will be watching the 1370 and 1360 levels closely as I think that we may be trapped in this area until the FOMC announcement and Fed Chairman Bernanke's press conference. If the bears continue to dominate prices and pull the XAU/USD pair below 1360, their next target will be the 1354.50 level. A daily close below this strong support level would make me think that we are going to test 1338 (or even 1320) next. To the upside, the first resistance is located at the 1370 level. If the bulls manage to break through 1370, the next challenges will be waiting the bulls at 1378, 1386 and 1400.