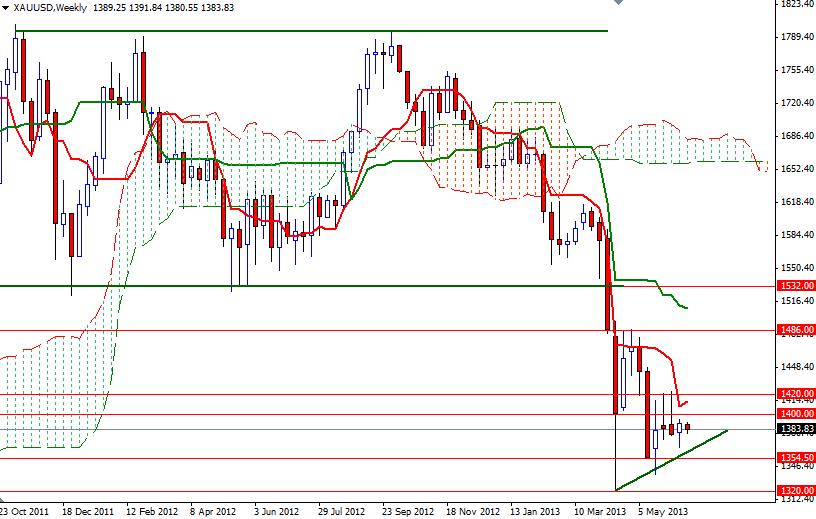

The XAU/USD pair (Gold vs. the American dollar) closed yesterday's session with a loss as the American dollar gained some strength after a report released from the Federal Reserve Bank of New York showed that its business conditions index rose to 7.8 from -1.4. On the other hand, the price action is getting tight and traders simply aren’t interested in going too far out on the risk spectrum ahead of the Federal Reserve's two-day policy meeting which begins today. Without doubt, the outcome of the Federal Open Market Committee (FOMC) meeting will be the next big market catalyst. Gold prices have been under pressure amid expectations the Fed will slow down its bond-purchase program. Investors start to believe that the Fed is going to alter its $85 billion monthly pace of bond buying based on changes in the economic outlook but I do not think that recent economic data were good enough to inspire any kind of change in monetary policy. However, there is still a possibility that the policy makers would surprise the markets. According to the Commodity Futures Trading Commission's weekly report, market players appear to be losing faith in the bull story for gold and because of that I don’t expect a major trend change soon. From a technical point of view, I think it makes more sense to wait until we break out of this tight market. Since the Ichimoku clouds are right on top of us on the 4-hour time frame, I can say that the 1400 resistance is first critical level for the bulls.

If they manage to break and hold above this level, we may see a bullish continuation targeting 1442. If that is the case, expect to see heavy resistance at 1420 and 1430. To the downside, support can be found at 1374, 1370 and 1360.