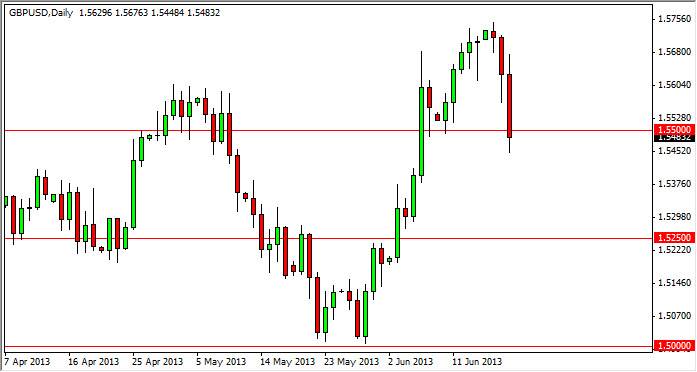

The GBP/USD pair fell rather hard during the session after initially trying to rally on Wednesday. The Federal Reserve meeting in minutes afterwards of course rattled the markets, especially when the Federal Reserve Chairman stated that the Federal Reserve may taper off of quantitative easing later this year, and more importantly be completely out of it by the middle of 2014. This is a full year ahead of time as far as the market was concerned, and of course this had money flowing into the US dollar as bond yields rose.

On the other hand, you have the United Kingdom which is unfortunately tied to growth in Europe. Europe looks rather weak, and as a result it will be quite a bit longer before the Bank of England is in any position to raise rates, or even allow them to happen. That being the case, we feel that this market could very well have a significant move lower if we managed to break the bottom of the range from the Wednesday candle. This shows the 1.55 level has been broken down, and there is follow through, something that will of course be crucial if we continue much lower.

On the other hand…..

You could of course see a supportive candle in this general vicinity. With that being the case, we have to wait and see how this all plays out. That's why I'm waiting until we get a break of the range for the session on Wednesday to make any decision to start selling. After all, if we formed a hammer in this general vicinity, it would be an excellent buy signal.

Going forward, it's all going to come down to how the markets interpreted, but it must be said that things will rather shaky at the moment. The US dollar certainly is underpriced at this point in time as it had been sold off so drastically lately, so continued weakness would exactly surprise me, and right now that's my base argument. If we do break the lows of the session on Wednesday, I feel that we will more than likely head down towards 1.5250 level.