The USD/CHF spent Friday much like it's causing the EUR/USD, trying to decide if it should go up, or down...or sideways. As a result, it finished the day with a total range of about 100 pips, but closed less than 5 pips from where it began the day. This resulted in an very indecisive daily candle and provides traders with trepidation as to how to trade this pair. The answer is simple, and not unlike the EUR/USD...stay out.

While the USD/CHF has actually had some nice, rather smooth movement over the last 2 weeks, it is just a little too close for comfort to the already uncertain EURO. The Dow Jones broke the 1600 level on Friday and since this is the first time, ever, it will likely fall before going back up. What this means is that if the Dow falls, the USD will get stronger as a result while investors flood back to its relative safe status. If this is the case we will surely see the USD/CHF climb as a result so re will be interested in resistance at levels such as the January high at 0.9388 and the Weekly R1 at 0.9438.

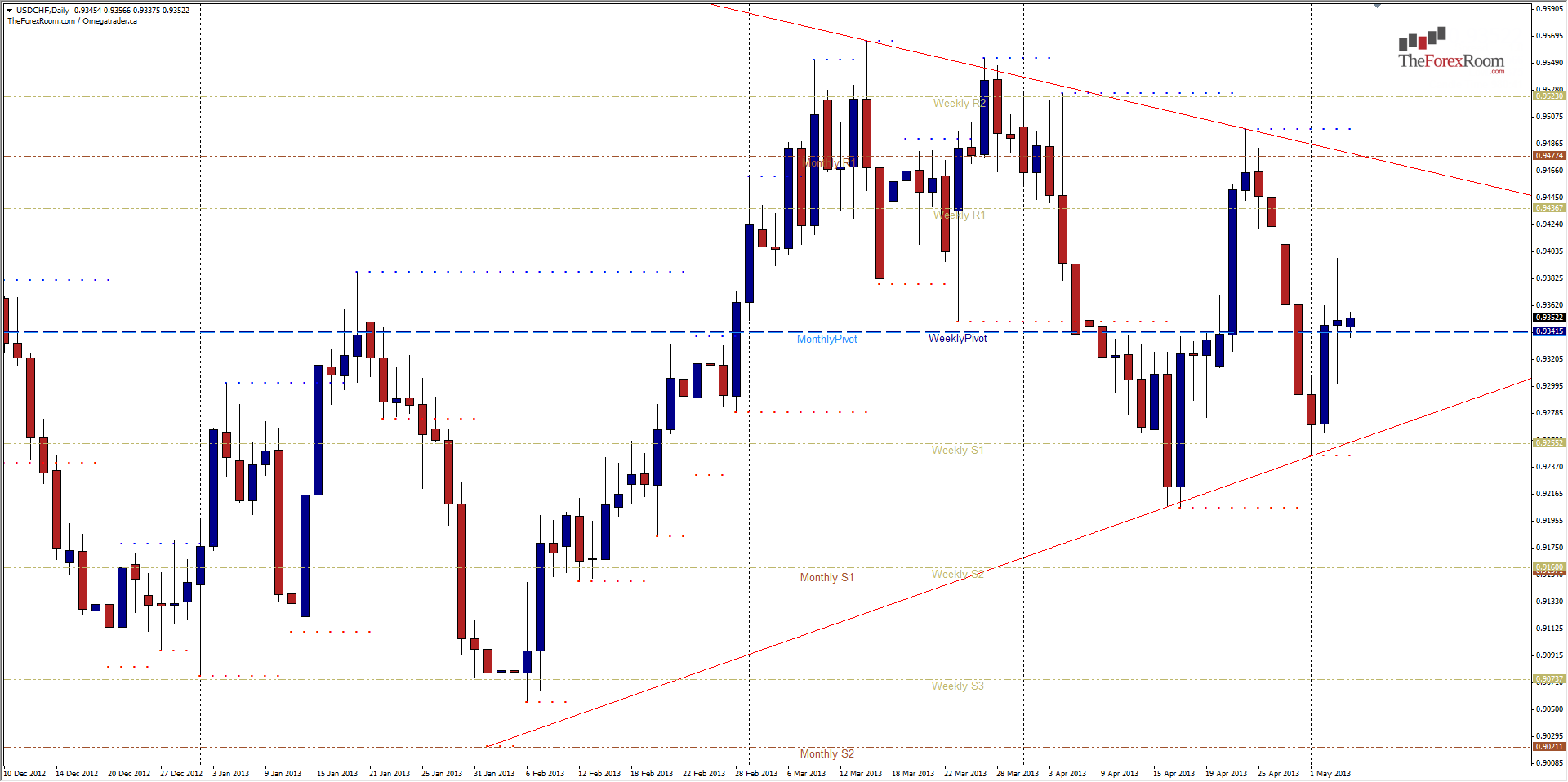

We also have a descending trend line that has formed from the high in 2012 to meet last week's high at 0.9498 perfectly and will intersect with the current Monthly R1 at around 0.9470. If however the USD continues to weaken we will be interested in support at 0.9340 where both the Monthly & Weekly Pivot both sit (another sign of indecision) and 0.9300 before we intersect with a rising trendline meeting the Weekly S1 at 0.9250. Until we close above 0.9500 or below 0.9200, we should be looking for quality intraday set-ups only, and getting out while the gettin' is good!