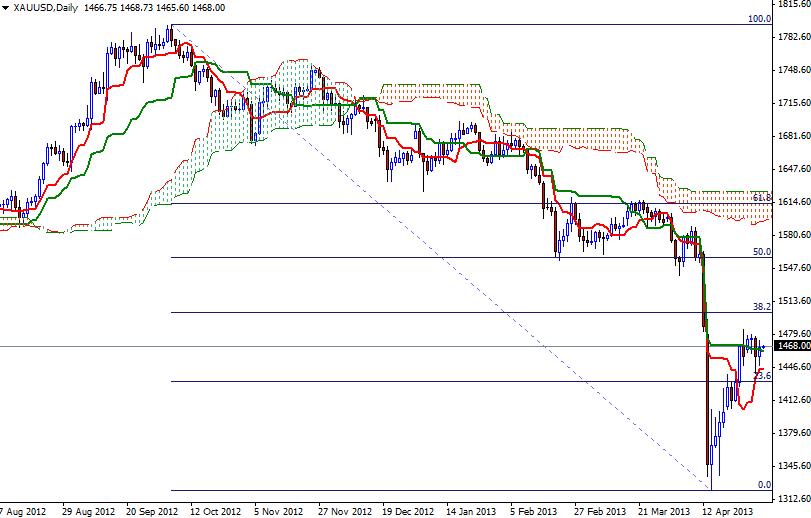

The XAU/USD pair is trading in the middle of the 23.6 and 38.2 Fibonacci retracement levels based on the bearish run from 1795.75 to 1321.52. Prices have been trapped within a relatively tight range for the last 6 days as the pair continued to meet sellers around the 1486 level and buyers came in at the 1444 level. Although weekly unemployment claims data out of the U.S. came out better than expected, there is a growing conviction that the Federal Reserve won't slow or to stop asset purchases before the end of 2013 and this is supporting gold prices at the moment. Prices are above the Ichimoku cloud and we have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross on the 4-hour time frame.

So speaking strictly based on the charts, it seems that there is still some room for the pair to run higher...but again, the key level will be 1486. If the bulls intend to charge, a close above the 1486 resistance would be necessary to gain enough traction to tackle 1498 and 1505. A close above 1505 would suggest that the XAU/USD pair may extend its gains. However, there are very strong resistance levels beyond and I believe the buyers will struggle to get above the 1532-1550 area which happens to be the bottom a previous giant consolidation zone. If the bears successfully defend 1486 and the pair turns south, the 1444 support will be the key. If this support is broken, I will be looking for 1430, 1411 and 1398.