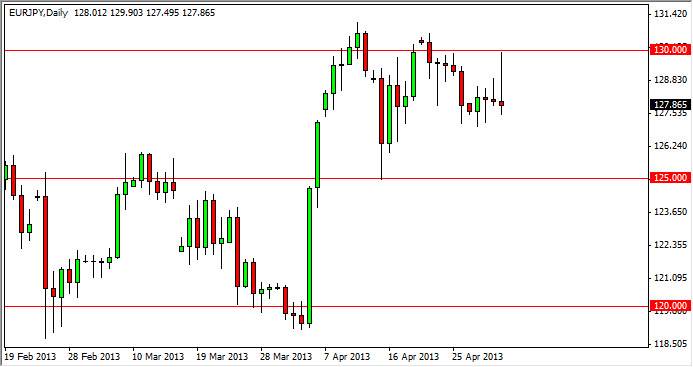

The EUR/JPY pair rose during the session on Thursday, but as you can see struggle that once it hit the 130 handle. This of course would've had been predicated upon not only that significant resistance area, but the fact that the European Central Bank did in fact cut rates during the session. However, I feel as if the market would have already known that was very possible, so the selloff is probably been a bit overdone to say the least.

The shape of this candle is perfect, so I have to give it that. However, if we do break down from this area as the candle shape would suggest, I think this will simply bring in a buying opportunity. This market tends to jive well with the "risk on" vibe around the world, and as a result I think any selloff due to a bad nonfarm payroll number for instance, will more than likely be a buying opportunity.

125

I think the 125 handle will be massively supportive, and as a result I think that any pullback towards that general vicinity will be supported greatly by a large majority of traders. After all, a slightly lower interest rate out of Europe is nothing compared to the ferocity in which the Bank of Japan will attack the value of the Yen if this pair falls apart. Simply put, the Europeans are out of their league when it comes to central bank intervention while jousting with the Japanese.

I believe that a break above the 131 handle signals the next leg higher in this market, and as a result I would be very long of this pair then as well. Going forward, I fully expect this pair to breakout, but the real question is whether or not it happens right away or after a pullback. My suspicion based upon this candle is that we may actually get that pullback, which I will simply envision as the Euro going "on sale" at this point in time. Regardless of what happens, I am not selling this pair under any circumstances.