The WTI Crude Oil markets had a positive session on Thursday, after initially dipping below the $94.00 handle. However, the hammer that had formed on Wednesday certainly suggested that there was support below, and we did in fact see that during the session. The biggest problem now is the fact that there is so much resistance above. In other words, I absolutely hate this market at the moment for anything more than a short-term trade.

Markets like this are very difficult to trade for anything more than maybe a $1.00 level type of trade, and as a result I will be switching my analysis the shorter-term charts in the near future. Another reason that we may be seeing this is the fact that we are coming close to the summer doldrums, which is course the time of year when most large traders are off on vacation instead of worrying about the price of oil.

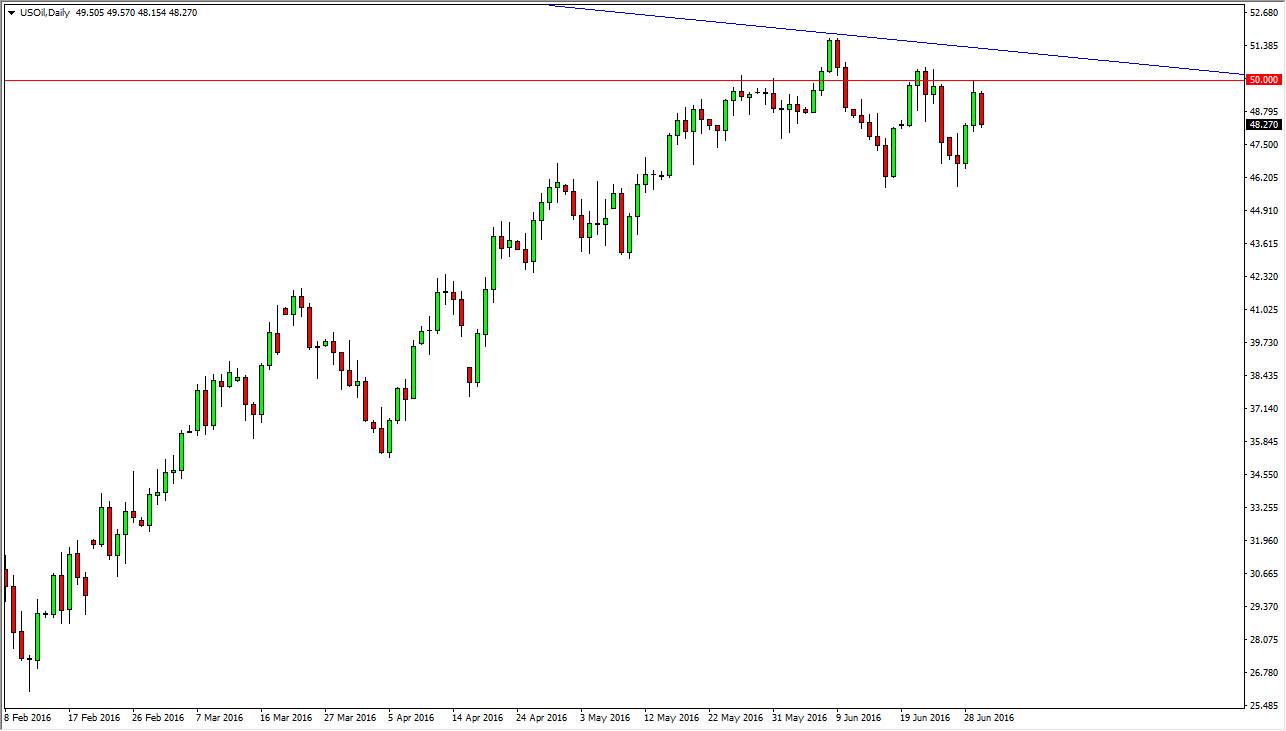

Range looks to be getting set

Judging the action that we've seen over the last couple of sessions, I'm starting to think that the range is starting to be said for the near-term. I believe that the $92.00 level on the downside should remain supportive, and that the $97.00 level should be resistive on the upside. Of course, there is always the threat of some type of headline crossing the newswires that moves the market in one direction or the other, but all things being equal I believe that this range should hold for the near-term.

The real question of course is “What kind of range will we be in for the summer?” I think we could see a little bit wider of a range, but in reality oil markets are probably somewhat overpriced at this point. The US dollar continues to strengthen overall, and this of course won't do me favors for the oil bullish traders out there. Going forward, I expect to see a pullback from near the $97.00 level, which I will be shorting for a very small trade. As far as longer-term successful trades are concerned, it might be a while before we see one.