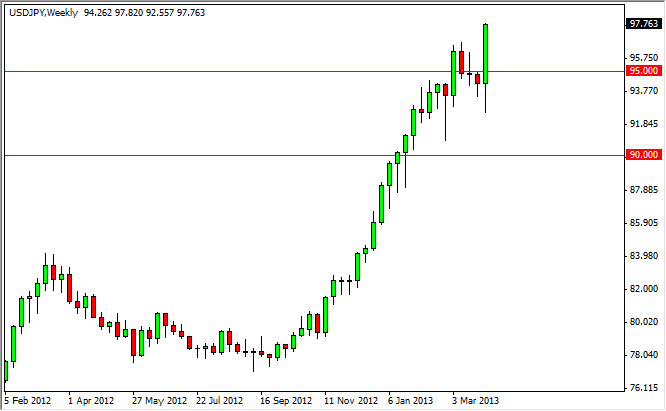

EUR/USD

The EUR/USD pair got a bit of a lift as the US Non-Farm Payroll numbers came out weaker than expected. Also, the ECB chose not to suggest that they were cutting anytime soon, although Draghi did infer he was “Ready to take action if needed” on Thursday. Anyone know what that means? Nonetheless, this was an excuse for a rally in this pair, which quite frankly has been oversold.

The 1.27 level still will be very resistive, and as a result I am not surprised that we bounced here. The 1.30 level was broken on Friday, although not significantly so. The pullback was a simple continuation of consolidation. This pair will remain choppy, and more than likely bounce around the current levels.

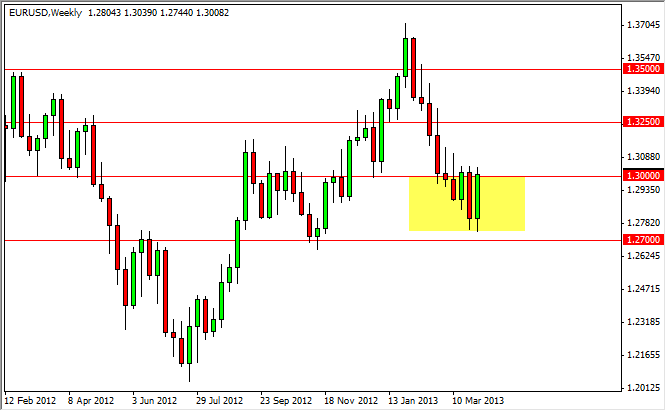

USD/CAD

The USD/CAD pair went back and forth during the week, and in the end was fairly neutral. This makes sense – both countries released horrible jobs numbers on Friday. However, I have been watching the 1.01 level for support, and it did in fact hold on Thursday. This suggests to me that we could be getting ready to see a move higher, but I wouldn’t consider that a safe trade until we break the highs from this past week. As far as selling is concerned, I wouldn’t be comfortable doing so until we close below the 1.0050 level.

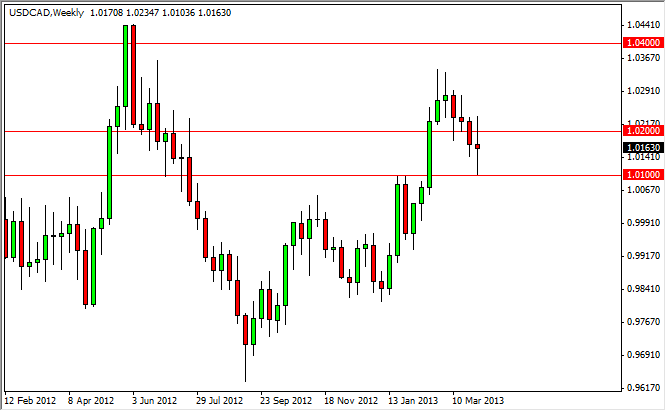

NZD/USD

Pressure continues to build in this market, but the overhead resistance is far too strong at the moment. The bulls are trying to breakout, but the 0.85 level must be overcome before we can really pick up steam at this point. With this in mind, my inclination is to be long of this market, but that area has to be broken before I am comfortable buying. However, based upon the larger consolidation area, I believe that move would signal a target of 0.95 over the long run.

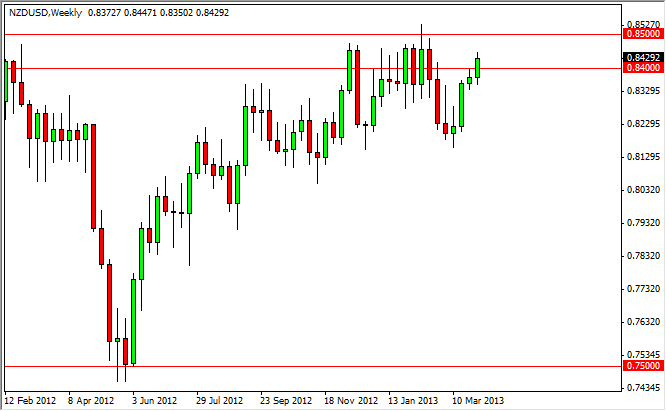

USD/JPY

Unless you were asleep the entire week, you know that the Yen-related pairs caught a massive bid on Thursday as the Bank of Japan expanded its monetary easing policy, and as a result this market broke above the recent highs on Friday. I fully expect this pair to head to the 100 level, and will be buying pullbacks as they come. Certainly you cannot short this pair at the moment.