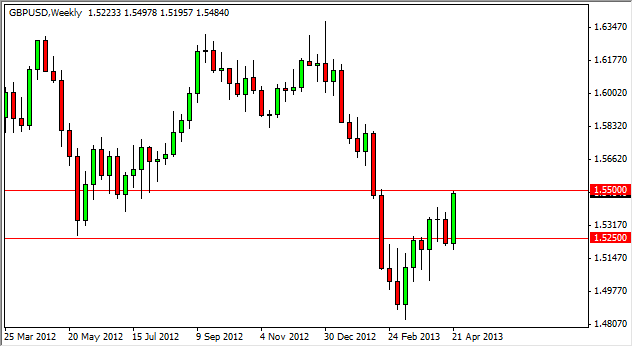

EUR/USD

The EUR/USD pair continues to chop around without any clear direction. The 1.30 level is without a doubt the “focal point” at the moment, and we find ourselves grinding away in a sideways market. The pair will continue to go nowhere fast, as the headline risks continually threaten both sides.

In Europe, there are concerns about the debt crisis which hasn’t directly been averted yet. Spanish unemployment is at an all-time high, and the region seems to be slowing down more and more every day. Also, isn’t there some type of issue with the Italian government – or did we forget that?

Of course, on the other side of the Atlantic, the Federal Reserve continues to print. This puts a bit of a bid in this pair as the European Central Bank hasn’t been cutting – although it is expected to before too long. Nonetheless, this pair should continue to grind, as there is no clear direction at the moment.

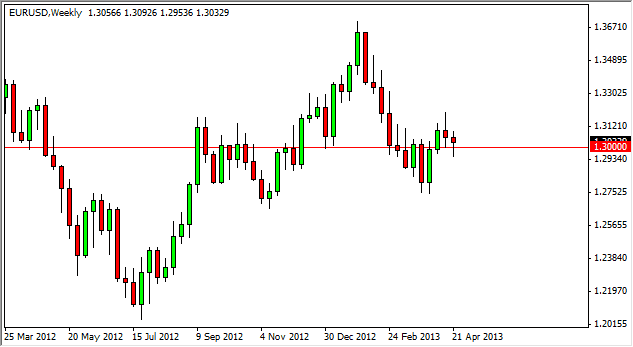

AUD/USD

The AUD/USD pair has been grinding away in a consolidation are for over 16 months now. The 1.06 level has been the top, while the 1.02 level has been the bottom. We find ourselves close to the bottom at the moment, and it appears that there is an attempt at forming a “rounded bottom” at the moment. Because of this, I think there will be an overall bid in this pair, but don’t expect anything along the lines of a strong move. This will be choppy with an upwards bias.

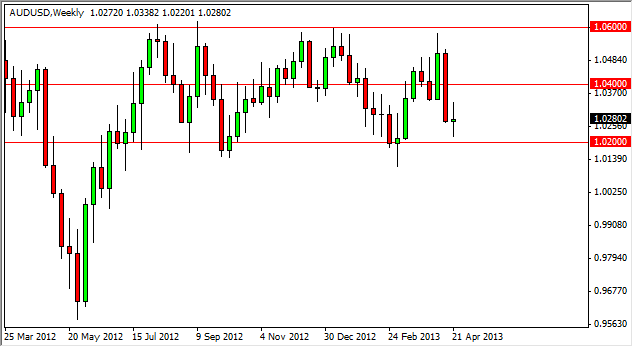

USD/JPY

How in the world hasn’t this pair broken above 100 yet? This is the question that I hear the most, and to be honest, the only reasonable answer to this question that I have heard is that there are massive option barriers in the vicinity. Sooner or later – those options expire, and those barriers disappear. When that does happen, this pair will be strong again. However, in the meantime it looks as if buying the dips is the best strategy in this market.

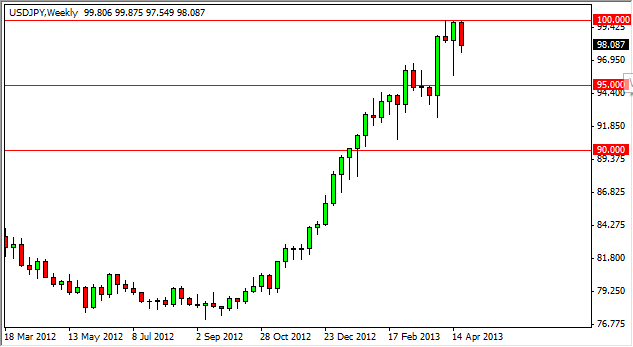

GBP/USD

The GBP/USD pair had a strong week, closing just below the 1.55 level. This area is going to be important going forward, as it needs to be overcome for the buyers to pick up more confidence. The area could very well cause a fall though, as it wasn’t overcome quite yet. The next couple of sessions will be vital for the future direction of this pair. The pulling back of this pair will more than likely be seen as a buying opportunity as the United Kingdom managed to escape a triple dip recession this past quarter, and as a result it appears there has been a bit of short covering. If we close above the 1.55 level on a daily chart – there probably won’t be much of a pullback, and I will be going long at that point.