After the Asian markets opened, Euro received a strong bullish impetus based on news coming from Italy. The newly (s)elected Prime Minister Enrico Letta has quickly settled to the task of governance by appointing 21 cabinet ministers and members of government.

No doubt, it’s good news for investors in the midst of all the recent turmoil within the Eurozone. The zone’s major economic event this week is the monthly monetary policy meeting held by ECB.

Dovish remarks from the Central Bank’s officials in recent times lead analysts to believe a rate cut is in view. More indicators pointing to sluggish growth in Germany and the entire continent add strength to this widespread speculation.

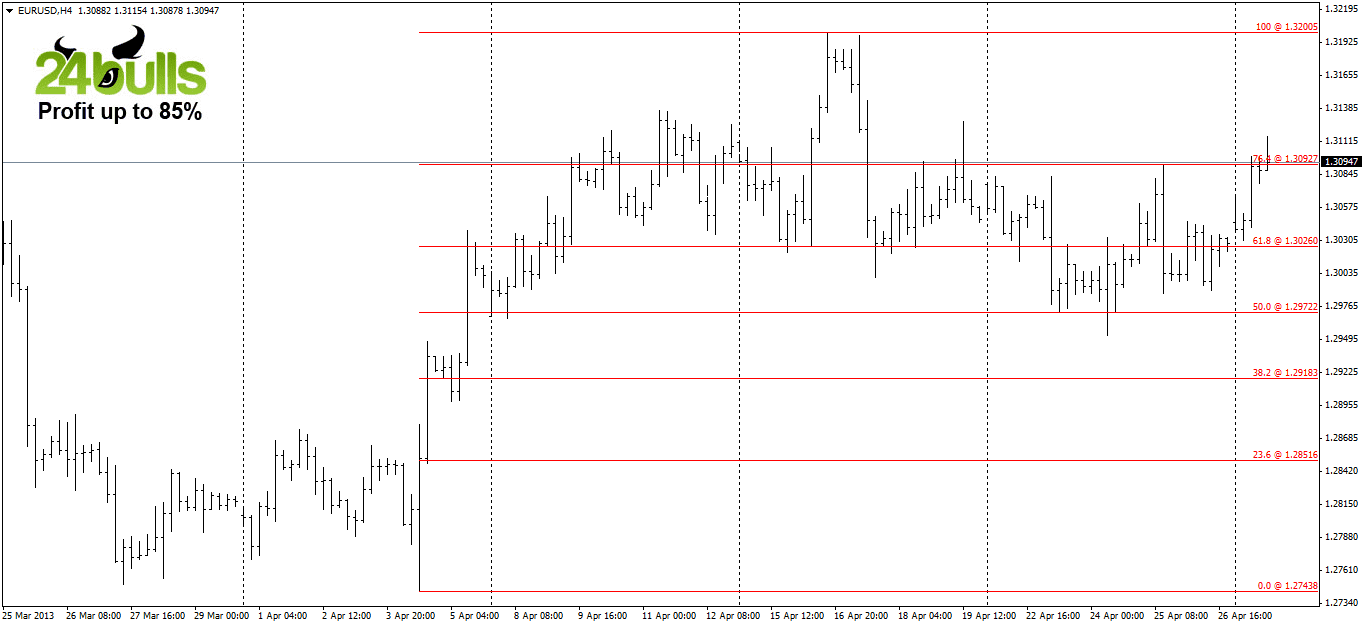

A 25bps consensus rate cut is expected to downsize the current rate to 0.50%. Consequently, EURUSD may find itself well below 1.30 if this happens. However, the pair has continually withstood negative news items especially in the past few months. So it may experience an initial risk-off bearish reaction, before it resumes a bullish turnaround if investors later interpret the move as positive for the long term.

Meanwhile, the Federal Reserve also has a date with the markets this week as it prepares to release its policy statement on Wednesday. Last Friday’s positive Q1 GDP for the US gives the Fed more evidence of a successful, ongoing QE exercise. The coming Friday’s jobs report will also be closely watched by its members to decide a timeline for slowing or ending the easing. Above 150K new jobs will provide some relief for stakeholders; but a print of over 200K is sure to inject that risk-on market environment investors crave at the moment.

There has not been a clear trend on 4-hour and daily timeframes so range trading is the best bet for now. Buy the Euro above 1.3200 towards 1.3425; otherwise sell below 1.2970 for a target at 1.2750.