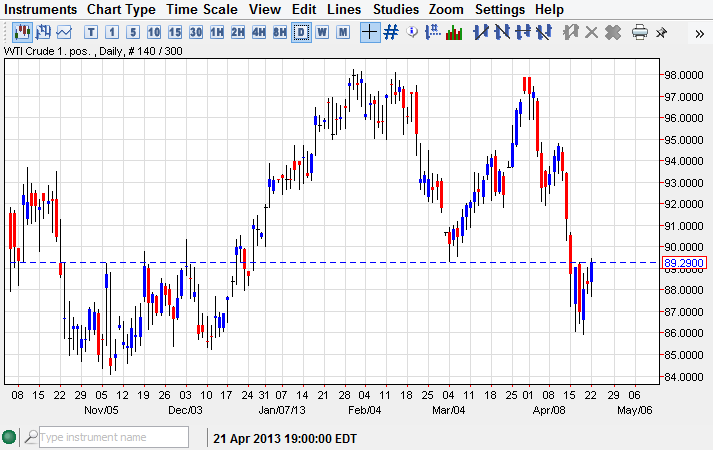

The WTI Crude Oil market rose during the session on Monday, breaking the top of the shooting star that had formed on Friday. This is obviously a very bullish sign, but I still am a little bit leery of going long at this point in time. I can make an argument for trying to buy it, and maybe hang on to the $92.00 level, but to be honest I barely have the conviction to even type those words.

Within this chart, I think it's probably easier to sell if we get some type of rally. There are a lot of fears of deflation out there, and that of course is bad for oil because there should be less demand. Also, the US dollar has been fairly strong lately, and I don't necessarily see that ending anytime soon. With that being the case, a lot of commodities may struggle.

Timeframe matters

It really comes down to your timeframe. If you are a short timeframe trader, you may find value in this market above the $89.50 level, aiming for the $92.00 level. I could see buying in that condition and trading very short term charts to do so.

However, I tend to be more of a swing trader, so this type of trade doesn't appeal as much. After all, you can see how sold off this market was and although it oversold bounce seems very likely, there is a reasonable sold off so drastically in my opinion. With that being the case, we also are coming up to the time of year where traders simply walk away from the markets to go on holiday. That can lead to very quiet trading conditions.

Going forward, I think this market will continue to be somewhat volatile, but it will have downside risks to it more than anything else. If we managed to break down below the $85.00 level, I believe it is at that point in time that financial ministers may start trying to jawbone the price. However, and the longer-term this market will go down. After all, it's only a matter time before the Americans actually start to drill for their own fuel. Once they do its lights out for the Middle East.

That of course was a long-term prediction.