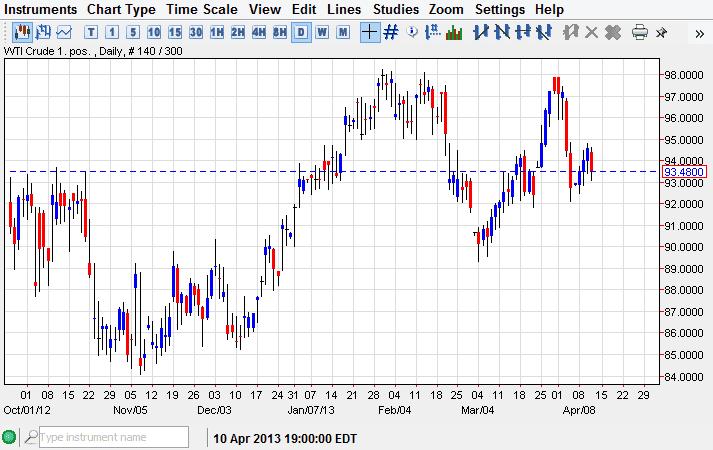

The WTI Crude market fell during the session on Thursday, reaching for the $93.00 level as support, and eventually finding it. The market did bounce from that level, and as a result it looks like the area of that is surrounded by $92.00 and $94.00 will continue to be messy and noisy.

Looking at this chart, it does look a little bit weak overall, but I believe that we are currently trying to find the range for the near-term. I believe that the $90.00 level will be a bit of a floor in this market, so I don't expect this contract to trade in below that price. However, I can also say that on the upside $98.00 looks very resistive.

Looking at the longer-term charts, I can see that there is potential for a symmetrical triangle being formed, and it does look like sooner or later we will get some type of breakout. The real question is whether or not we break out with any type of force to the up or downside, or if we simply drift sideways through the end of the triangle, essentially signaling that we are going to meander around during the summer months.

Short-term trader’s market

I believe that the way this market is starting to pan out, is going to be a short-term type of market for the most part. After all, we're talking about an $8.00 range that has several minor support and resistance levels within it. That makes for a messy and tight market, and as a result I think that any trade you take will have to be followed closely.

The more conservative way to trade this is to simply wait into we get to one of these major areas. Obviously, shorting at the $98.00 level would be a relatively low risk trade, just as buying at the $90.00 level would be. Going forward, I think that day traders will simply take over this market, and then anything that remotely looks like an investment will be dangerous. I also would recommend trading with half the normal size, as I expect a lot of choppiness in the near-term. As for directionality, I would have to say that it is probably to the downside at the moment, but only slightly so.