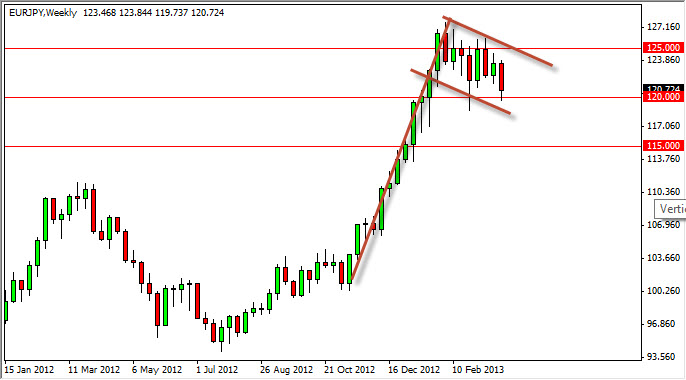

AUD/USD

The AUD/USD pair initially rose during the previous week, but as you see on the chart the pair simply couldn’t hold onto the gains. The pullback resulted in a shooting star, and as a result I am curious to see what the 1.04 level can do. After all, I believe this is a “middle point” in the larger consolidation that we have seen for the last 18 months or so. The top of the rectangle is at the 1.06 level, while the bottom is at the 1.02 handle. I think that perhaps staying away from this pair for the next week might be prudent, but I am very interested in how this week’s candle prints.

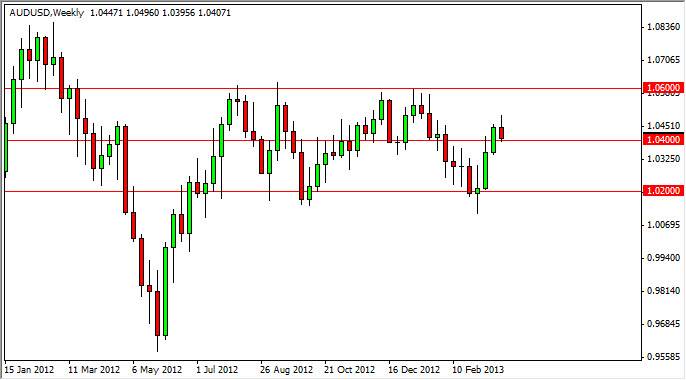

EUR/USD

The EUR/USD pair continues to fall overall, and this was exaggerated this past week because of the potential problems with depositors in various countries around the EU. After all, if the depositors can be forced to help recapitalize a bank in Nicosia, why couldn’t the same thing happen in Athens, Lisbon, or Madrid? This throws a lot of uncertainty into the conversation as far as the future of the currency is concerned, and as a result I think rallies are going to provide selling opportunities.

It’s amazing to me….after several returns to the European crisis – I am sure someone out there will convinced that the crisis is almost over, and will be buying Euros as a result. However, I think we are going to be having thi9s conversation over and over – until someone finally takes a serious loss. Rallies are selling opportunities at this point.

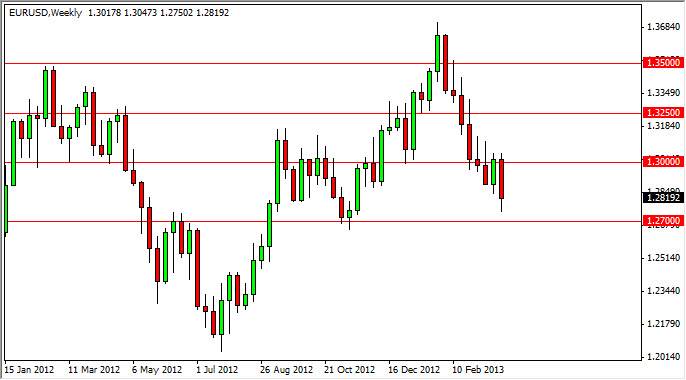

USD/CAD

The USD/CAD pair fell over the course of the last week, and quite frankly – I have been waiting for it to. I think that the original breakout point of 1.01 still needs to be retested for support, but this candle is encouraging as it makes me believe we might see that this coming week.

If we can get the support that I am looking for at the 1.01 level, I think this pair could bounce right back to 1.03 where it will meet resistance again. Beyond that, the 1.04 level will be massive in its implications as well. Above there and we take off. As far as selling is concerned, if I want to buy the Canadian dollar, it will be against the Yen or Euro.

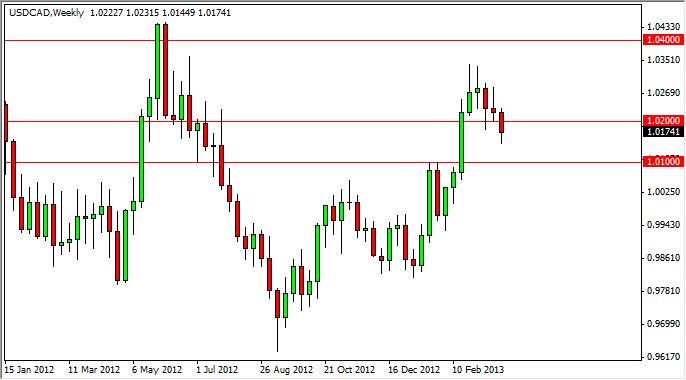

EUR/JPY

This pair is truly interesting to me from a long term perspective. I think this pair could really take off to the upside, and this will be especially true if confidence in the Euro comes back for some strange reason. After all, just look at the move we have seen so far. What is that I see? A potential bullish flag? If it is and we break out to the upside, the move implied would be to the 145 level!