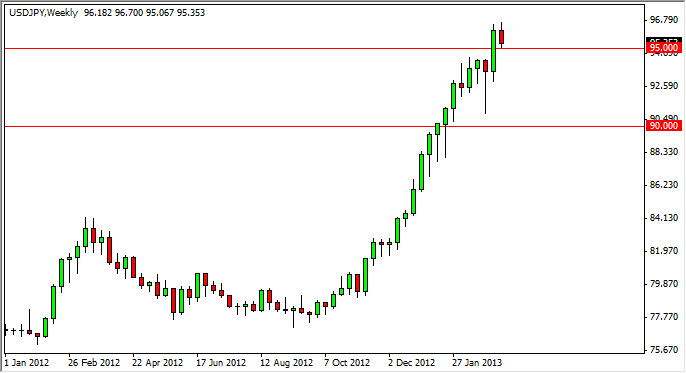

EUR/USD

The EUR/USD pair continued to bounce around the 1.30 level, an area that I believe will be vital to the longer-term momentum in this pair. This market should have a lot of support down to the 1.28 level, while the 1.3250 level continues to offer resistance.

This market will also have a bit of a headwind out of Italy. The parliament out of that country is supposed to be trying to form a coalition government, and as a result I think this pair will have trouble getting some kind of traction. The real surprise would be if they actually managed to do it. If so, this pair would shoot straight up.

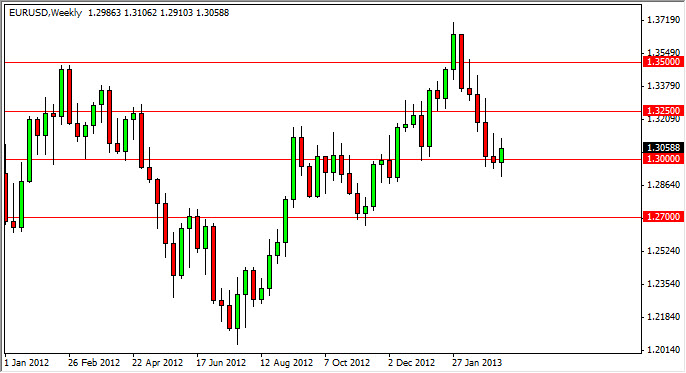

EUR/GBP

The EUR/GBP pair continued to bounce around between the 0.86 and 0.88 levels this past week. This market continues to offer a lot of sideways action, and this is probably because of the fact that both economies and currencies are going to face serious headwinds. Europe has Italy and debt issues, while the Brits have a weak economy. In the end, this pair looks like it will eventually breakout to the upside, and on a close above 0.88 – I think we see 0.90 at the end of the move.

AUD/USD

The AUD/USD pair shot straight up over the course of the previous week, slamming into the 1.04 level. This level is the “midpoint” of the larger consolidation area. The 1.02 level caused the bounce again, and as a result I think that the pair is going to try and reach the 1.06 level before it’s all said and done.

What I like about the pair is the fact that the pair ended at the very top of the range. The market is a buy as far as I am concerned, but I want to see a little bit of a pullback. The 1.03 level would be a great place to find support on a shorter time frame in order to take advantage of the larger time frame consolidation rectangle.

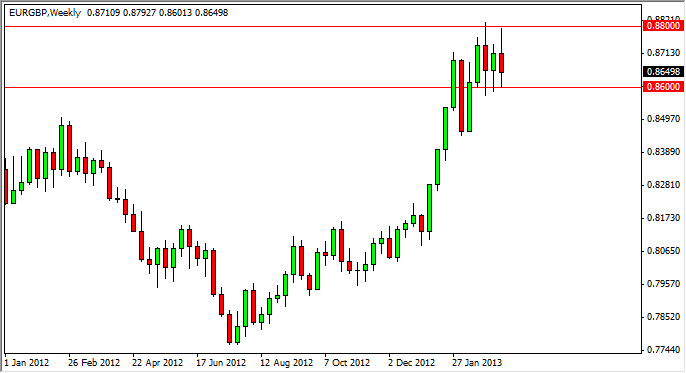

USD/JPY

The USD/JPY pair had a negative week, but in the end it is hardly a selling opportunity. The pair has been in a massively bullish move, and I think this pair continues to go much higher. Interestingly enough, the 95 level held as support. The area was once resistance, and now looks like it will be tested as support as the art of technical analysis dictates. The area down to the 94.50 level looks like a potential buy area. In the end, this pair should continue to be a “buy on the dips” type of market.