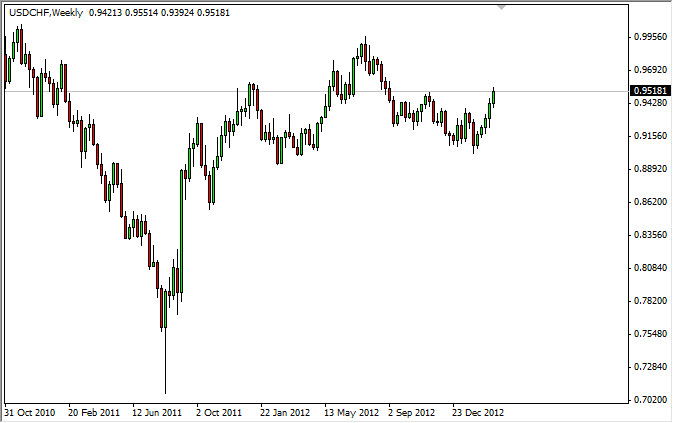

EUR/USD

The EUR/USD pair attempted to rally during the previous week, mainly because of the ECB’s failure to expand any type of monetary policy for the region. With this being the case, the “weak hands” got flushed as they covered their short positions. However, the non-farm payroll numbers came out of America as adding 265,000 jobs in the month of February, and this sent money back into the US, and away from Europe as a result.

The pair formed a shooting star at the bottom of the down move, which to me normally suggests continuation of the fall, but there is a significant amount of noise below the 1.30 level, and as a result I think the downside is somewhat capped at this point. I still expect a fall, but this won’t be easy.

USD/CAD

The USD/CAD pair gained again during the week, but seems to be “tired” at the moment. This doesn’t’ surprise me frankly, as the breakout has been pretty strong. Also, we are approaching the 1.03 – 1.04 level, an area where I see a lot of resistance coming into play.

With this being the case, I am looking for a pullback to the 1.01 level, the site of the original breakout, and a potential “floor” in this market. This would allow those who missed the rally to join in. However, there is also the possibility that we go ahead and break through the 1.04 barrier, and if that’s the case, I would have to be long as well. I have no plans to sell at the moment.

GBP/USD

The GBP/USD pair simply can’t get out of its own way at this point. The pair has been falling drastically over the last couple of months, and the fact that we finally closed below the 1.50 level this past week suggests that we are going to see even more weakness in the future. I am already short of this pair, and the second shooting star shaped candle in a row on the weekly chart certainly encourages me to stay that way.

The 1.5350 level would have to be overtaken at this point for me to even consider buying this pair now. With that being the case, I think that rallies will continue to offer selling opportunities as well.

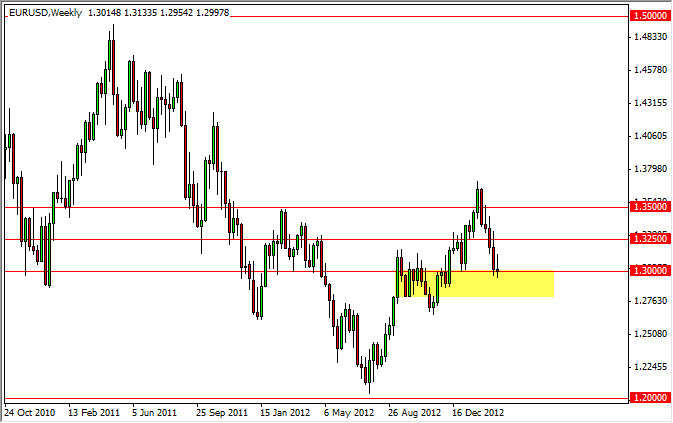

USD/CHF

The USD/CHF pair has been moving quite nicely while you haven’t been paying attention. How do I know this? Nobody has been paying attention to this pair. The Swiss National Bank effectively killed off the long Franc move a while back, and since then the trading community has chosen to simply focus on other currencies. With this being said, we closed above the 0.95 handle this past week, and are heading towards parity.