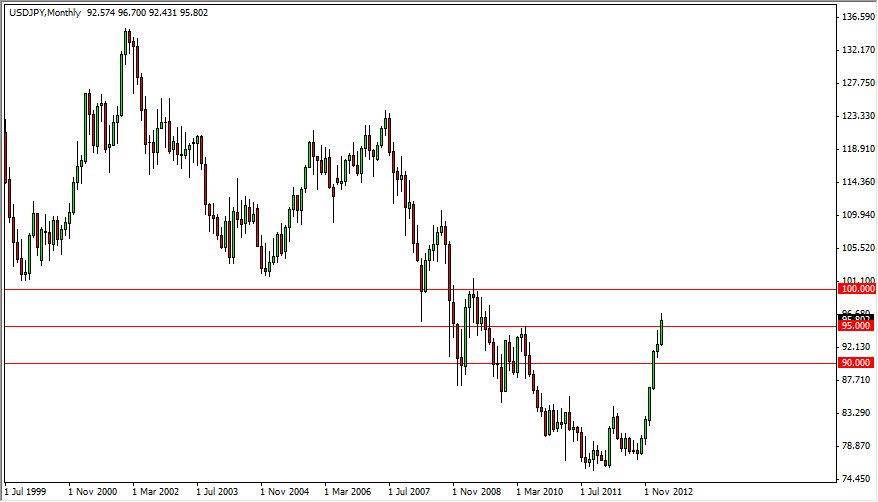

The USD/JPY pair has been a shot straight up. In fact, this market has moved so substantially that this forecast requires not only the weekly chart common in quarterly forecasts, but a monthly chart that will show off the movement more eloquently than a weekly chart could. The market has essentially ran from the 75 handle all the way to the 96 handle over the course of six short months. What makes this truly impressive is the fact that the Federal Reserve continues to enter quantitative easing, which of course should be putting a weight on the US dollar.

The Federal Reserve and the Bank of Japan are currently trying to devalue their currencies, and as a result there could have been significant concern about trading this pair going forward. However, during congressional testimony recently, Dr. Ben Bernanke stated that he "fully supported the Bank of Japan and its effort to inflate the Japanese economy." This is significant because it suggests that the Americans aren't overly concerned about the ascension of the US dollar against the Japanese yen. In other words, this isn’t a fight between two central banks, at least not directly. In other words, the Japanese are free to depreciate and the value is as much as they want. I suspect the Americans won't say a word about it unless it gets to be extraordinarily parabolic. Considering the last six months, it looks like there's plenty of appetite to buy this pair going forward.

During the course of the coming quarter, traders can expect to see the 100 level hit. I think that will be a major barrier for the market longer-term, but it will eventually be overtaken. The Bank of Japan has done this before, and was successful back in 1995. With the Federal Reserve out of the way, this pair could be entering a multi-year bull run, and it may be worthwhile to buy this pair every time it dips over the course of the next two or three years. In fact, this market may very likely print a 123 handle sometime in 2015.

However, there will be pullbacks. But over the course of the next several quarters and certainly Q2 2013, every time there’s a pullback that finds support at anything resembling a support zone, it's time to start buying. As for selling, you may want to hold off on that option for the foreseeable future.