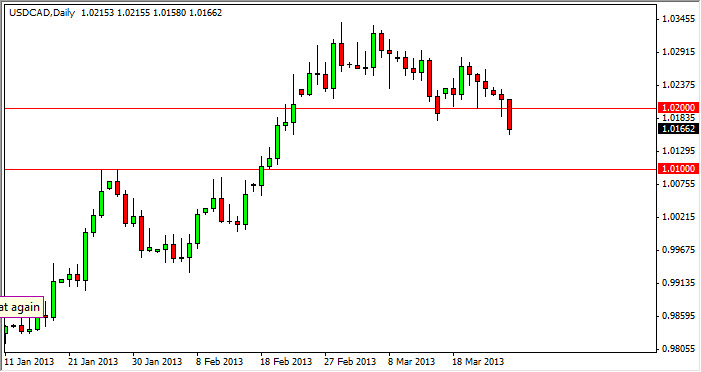

The USD/CAD pair fell through the 1.02 level during the session on Tuesday, in order to push the value of the Canadian dollar higher. This is a move that I've been waiting for quite frankly, as although I am bullish of this market right now, we needed to get some type of pullback.

A while back, we broke above the 1.01 level, which for me was the top of a significant triangle. The fact that we managed to break above that told me that this market was going to go higher, but we never went back to retest that previous resistance as support. Now that we've broken below the 1.02 handle, I believe that we will eventually have that opportunity.

During the session on Tuesday, we saw the oil markets really get bid up, and as a result the Canadian dollar gained in value. This isn't a surprise as it is the correlation that we normally see between these two markets. However, I see the 1.01 level as being important, and at the same time I can see that both the Light Sweet Crude markets have resistance at the $98.00 level, which is just above current pricing. If that's the case, we should have too much farther to go before we see some type of pullback.

Synchronicity

If this scenario plays out there way I see it happening, we will not only see the oil markets pullback in a couple of days, and we should see this pair bounced. That in theory could have this market bouncing rectally off the 1.01 level that I'm paying attention to. If that's the case, then we have to turn our attention to whether or not this pair can get above the 1.04 handle. If it does, this market could go much, much higher.

Above the 1.04 level, I believe that we will see the 1.08 level before the move is all said and done. Granted, this is normally a "risk off" type of trade, but with all of the bank issues in Cyprus and the EU in general, it's not that hard of a scenario to envision.