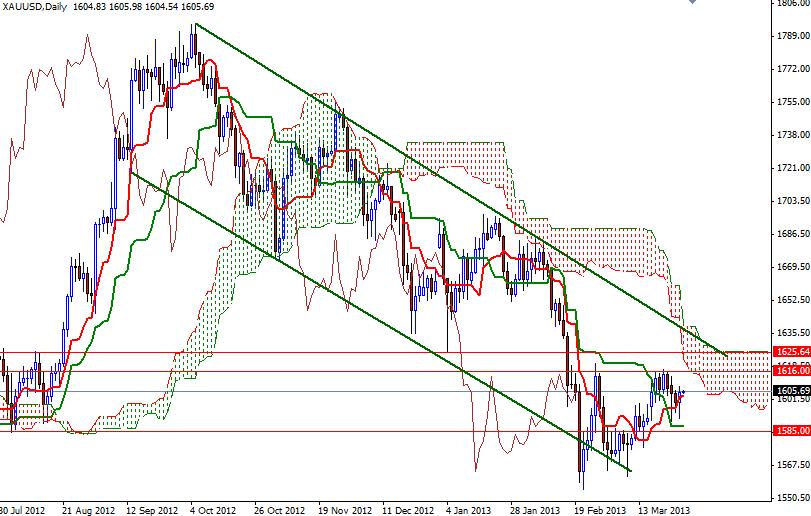

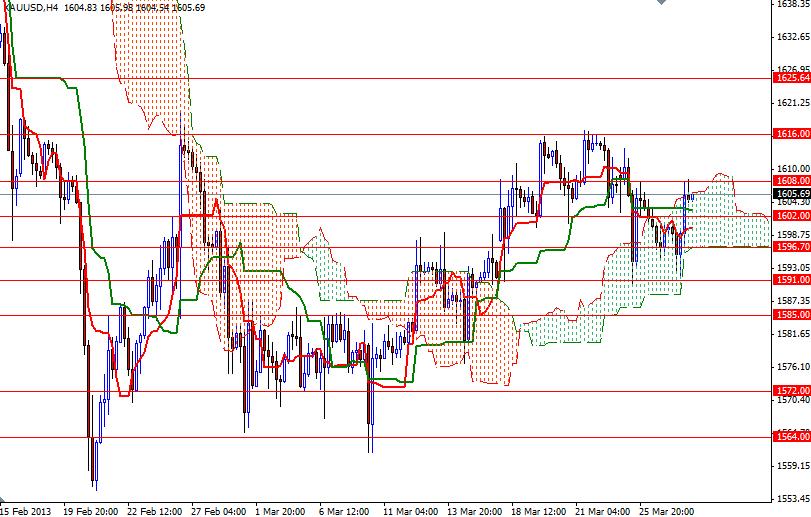

The XAU/USD pair closed Wednesday's session higher than opening after three consecutive days of losses. The pair found support around the 1591 support level and turned north after two voting members of the Federal Open Market Committee, Chicago Fed President Charles Evans and Boston Fed President Eric Rosengren said the central bank should continue its large-scale asset purchases through the end of 2013. Gold also drew strength from weaker than expected pending home sales data. Although the broader directional bias remains weighted to the downside, I wouldn't ignore the fact that there is a good possibility that gold prices will climb higher to test the critical resistances at 1616 and 1626. The recent price action indicates that the war between the bulls and bears intensified in the 1608-1591 zone where the Ichimoku clouds reside on the 4-hour chart and because of that I will maintain a neutral bias until we get out of this range completely.

From an intra-day perspective, the key level to the upside will be at 1608. If the bulls break above this level, buying pressure would increase and push the pair to the upper band of the ascending channel which currently sits at 1635. But before reaching that point, the bulls will have to pass 1616 and 1626 resistance levels first. To the downside, the key level today will be 1596.70, the bottom of the Ichimoku cloud (on the 4-hour time frame). If this support gives way, expect to see more support at 1591 and 1585. If the bears drag the pair below 1585, there will certainly be lower prices soon after.