Gold prices settled lower yesterday, extending losses to third straight session, as the mild disappointments in U.S. data failed to have a lasting impact on the greenback. The Conference Board’s consumer confidence and Commerce Department's new home sales data were weak but were more or less in line with market expectations. Another report showed that demand for durable goods increased in February. Although Cyprus avoided a major financial meltdown, conflicting messages from EU lawmakers have left investors completely confused. Usually gold tends to gain during times of uncertainty, as the metal is widely regarded as a store of wealth, but it appears that stronger dollar and sharp climbs in U.S. and Japan equities dulled gold's attractiveness as a safe-haven asset. Because of that, I think the precious metal's fate will likely depend on what direction major equity markets will take. Therefore only a strong correction in these markets might prompt funds to get back into gold.

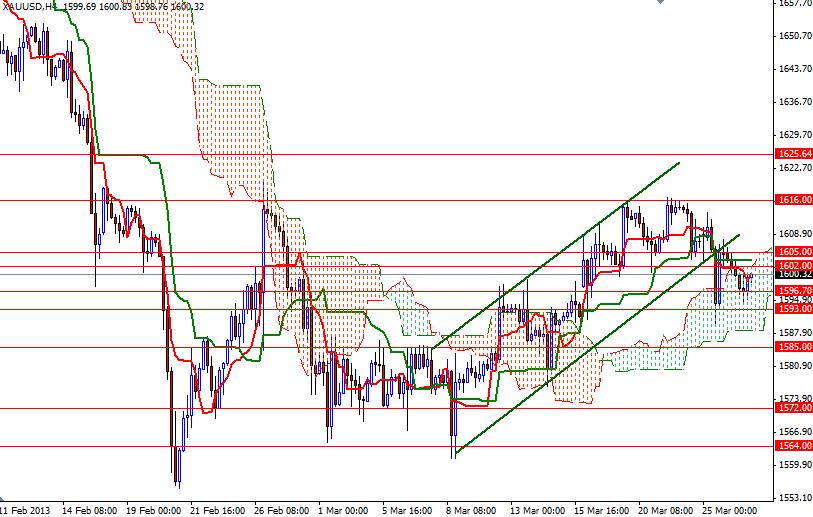

In the meantime, the trading range is getting tight again and prices are moving within the Ichimoku cloud on the 4-hour time frame. In the short-term, I believe that 1602-1596.70 range will contain the market. If prices resume the bearish tone of the last few days and break below 1596.70, I expect to see some support at 1593 and 1585.

A daily close below 1585 would confirm that the bears are firmly in control. If that is the case, I will be looking for 1572 and 1564. If the bulls take over and manage to shatter the first barrier in the 1602-1605 zone, we may see another bullish attempt to reach the 1616 resistance. Until we break out this descending channel that the XAU/USD pair has been running in since October 2012 (i.e. prices close above 1626), it will be risky to buy gold on a long term basis.