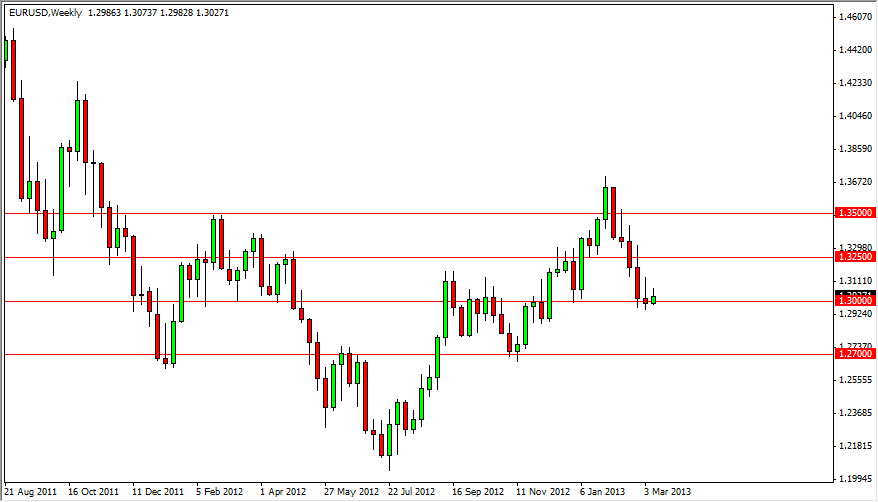

The EUR/USD pair has been pretty wild over the last couple of years, as you can see it seems like every time we move in one direction, suddenly we get a reversal and start running in the other. It has been difficult to find a trend that lasts for more than a few months, but in reality when you look at the larger picture, you can see that the monthly chart shows that we are indeed making lower highs over time.

This suggests to me that there is always going to be a bit of a downside risk in this pair. Of course, the Euro seems to defy gravity at times, as hope earns eternal for the bulls. Nonetheless, I can see several areas in this chart that will certainly create some type of reaction.

As I write this, we are currently trading at the 1.30 level, an area that has been massively supportive as well as resistive over the last several years. Looking at the weekly chart, I can make a case for a move down to the 1.27 level before it's all said and done. At that point, we reach the next significant support and resistance level, which leads me to believe that we will eventually see a bounce from that area. In fact, I suspect that as soon as the political situation in Italy is put to bed, the Euro will rally for the short term. Until then, I think there will be a weight around the neck of the Euro.

Ultimately, the Euro is completely broken. We are starting to hear talk out of politicians and various countries about how the common currency is simply untenable. I still believe that eventually we will see the breakup of this currency. However, this is going to happen overnight, or any time soon for that matter.

Looking at this chart, I think that most of Q2 will be spent between the 1.27 and 1.3250 level. I also think the trading will be very choppy, and very susceptible to headline risks. In fact, this is one of the more risky currency pairs that I see going into this quarter. Because of this, I believe that it will essentially be a short-term traders market, and traders will have to pay attention to the 1.27, 1.30, and 1.325 levels for reaction.