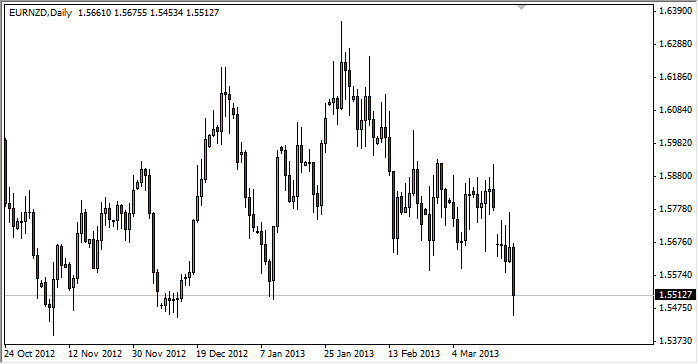

The EUR/NZD pair fell during the session on Thursday as the Euro continues to suffer. If you look at the Wednesday candle, you can see that we had formed a shooting star after filling the gap from the weekend. This makes sense that the sellers stepped back into the marketplace as you look at the candle set up. Looking at this chart, it's obvious to me that the 1.55 region is an area that is significant support in this market.

The fact is that the New Zealand dollar did fairly well on Thursday. Also, it should be noted that the Australian dollar did as well. This could be more or less a look at where money is flowing around the world, as it leaves the uncertainty of Europe, and heads towards Asia-Pacific region. After all, if you were a European that was looking to move money across the world and into the Asian market, what better place could you find than Australia or New Zealand as they are both so advanced?

Significant support

Don't get me wrong, there is significant support in this general vicinity. But the way I look at this chart is that it is an amalgamation of both the EUR/USD and the NZD/USD pairs. When you look at this market, it is obvious that the Euro is struggling while the New Zealand dollar has suddenly woken back up. Because of this, it makes sense of this market continues to fall and I believe that shorting it will be the way to go.

Many people overlook this pair, and I've never understood why. Both are major currencies, and the spread is typically something along the order of six pips. With that being the case, there's really no reason to avoid it and as you can see it is a nice range bound currency pair. At least normally it's fairly range bound.

I will be watching the price action over the next couple of sessions, and possibly shorting this pair below the 1.5400 level as it would be a complete breach of the support.