The EUR/USD pair sold off drastically on Monday as details of the Cypriot bank bailout became public. Originally, many of the traders in Asia trying to push the Euro higher, as the markets finally got some type of solution.

However, it didn't take long for people to understand that the senior bondholders of the Cypriot banks were about the taken massive haircut, and equity was going to be wiped out. More damning, the bailout was partially funded by savings accounts that contain more than €100,000 which crosses a "red line" as far as trust is concerned with the banking system.

So then the next natural reaction happened, people began to question whether or not it was going to be safe to keep their money in some of the peripheral banks of Europe. The banks in places like Spain, Italy, and Ireland suddenly didn't seem as safe as they once were. If that's the case, most people would just as soon not bother with the Euro zone in general.

As soon as confidence is lost, the currency sells off. This makes sense, and money flooded in the United States. After all, is the "safest" currency in the world, so it makes sense of the Euro lost to it. However, it should be noted that the Euro lost to just about everything during the session, and as a result it seems that an excess of money flowed out of the continent.

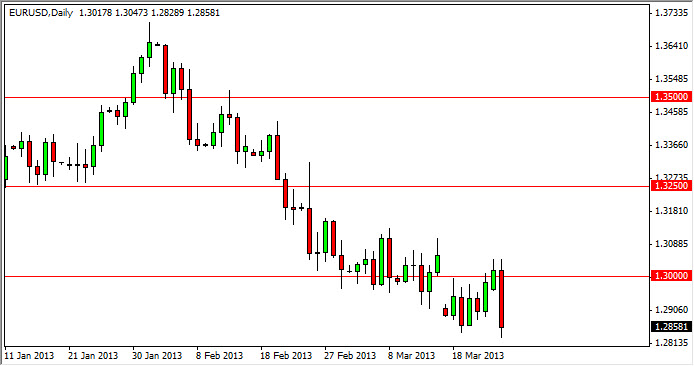

Massive support below

The problem now is that there is a massive amount of support below the current area that we find ourselves out. With that in mind, is very difficult to short the Euro, but I certainly have no intention on buying it. Quite frankly, and I believe that it's probably easier to simply let this thing bounce a bit, and short it from higher levels in order to pick up a bit of momentum.

With that extra momentum, I believe that we could possibly break down, but at least you would have the room to move. I think the 1.2850 level is the starter pretty significant support, so at this point time I will not be shorting this market although I believe it will eventually grind lower.