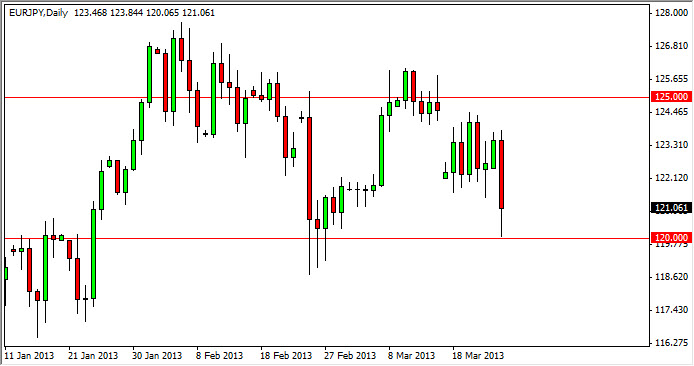

The EUR/JPY pair sold off drastically during the session on Monday, as the Euro was punished in general. The In gained against most currencies, but saw a bit of a bounce towards the end of the session. In this particular pair, it makes sense that we took fairly significant losses as the Cypriot bailout continues to cause nerves in the marketplace.

As it was released that the senior bondholders were going to take massive cuts, the Euro got absolutely pummeled during the session. With that being the case, it makes sense that this extremely volatile pair got hurt as well. However, you can see that the 120 handle did hold a support, as one would expect considering that it is such a massive and important area.

Look at this chart, the 120 handle should be an opportunity to start buying again if we get enough of a supportive candle. If that doesn't happen, then I would be very hesitant to short this market as there is so much in the way of noise below that level. In fact, I am essentially hoping this market comes back to the 120 handle and forms some type of supportive candle for me to start buying.

Hard bounce

Unless there some type of massive melt down in Europe, I suspect that the 120 area should create some type of hard bounce. After all, during the session we saw this market bounce roughly 100 pips from the bottom. This was a pretty quick move, and shows just how much it's going to take to break down through that area.

I believe that the fact that we fell roughly 3 handles from the start of the session also help, as there was simply nobody left to start selling at that point. Going forward, I think that this could be a very volatile market, but eventually we will find some stability in the Euro, and of course see this market go higher as a result. The Bank of Japan has no interest in watching the Yen appreciate for any length of time, and the market certainly knows this.