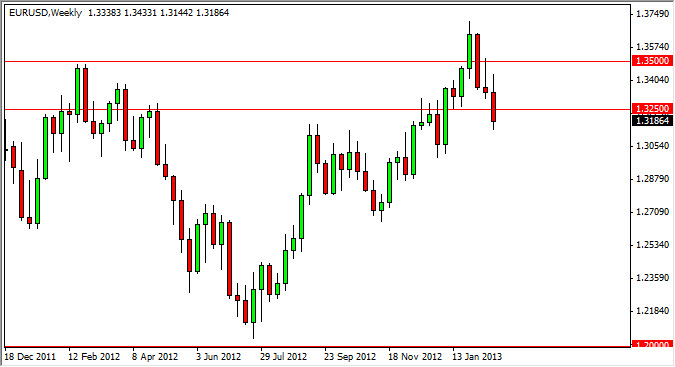

EUR/USD

The EUR/USD pair fell significantly as we chomped through the 1.3250 handle. This area had been supportive recently, and the fact that we fell for it does look relatively bearish. However, we see quite a bit of support at the 1.3150 in my opinion, and we have to worry about the Italian elections on the 25th. Because of this, is very difficult, with some type of bias in this marketplace, but I do believe that we may fall a bit further to the 1.30 handle, and then simply continue higher.

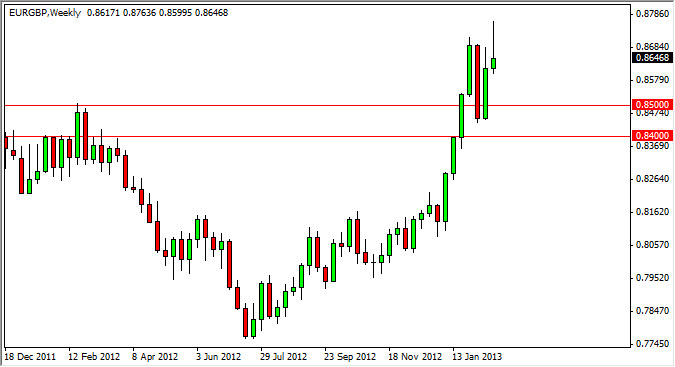

EUR/GBP

The EUR/GBP pair initially surged higher during the week and found the 0.8770 area far too strong to overcome. The Euro should by all measures be stronger than the Pound, and as a result I believe that this shooting star that formed is a very sign, but only a mild one. I personally believe that the shape of the candle signals that we may reenter the consolidation area and perhaps test the 0.8450 area for support. I also believe that area will hold, and that we will bounce from that general vicinity in order to stay within the consolidation zone overall.

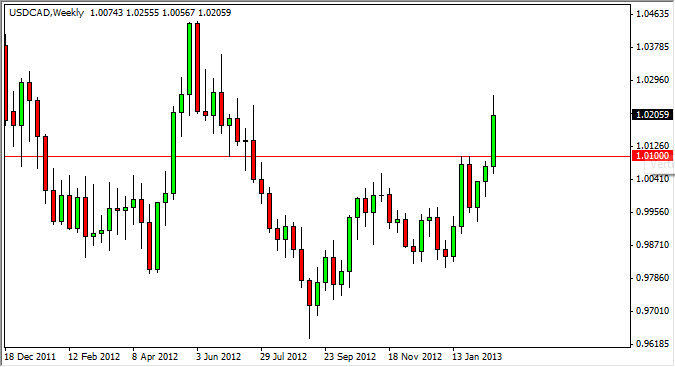

USD/CAD

The USD/CAD pair shot straight through resistance at the 1.01 level during the past week as the Canadian dollar simply has not been acting quite right. The 1.01 area was significant resistance, and as a result I think this market has a lot more left in the tank. However, a pullback to retest that area as support is more than likely, making this a potential "buy on the dips" type of market over the next couple of sessions. I believe that we will eventually test the 1.04 level, and possibly as high as the 1.05 handle.

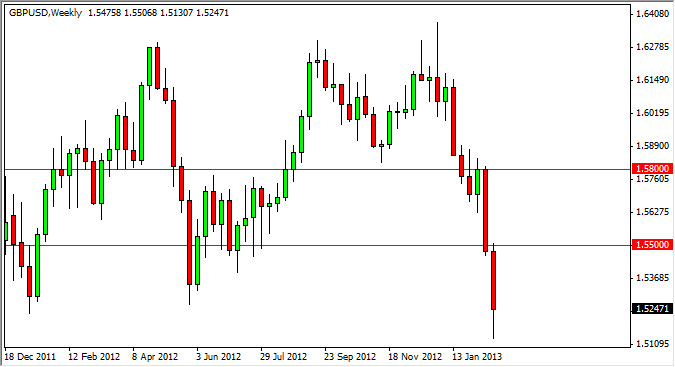

GBP/USD

The GBP/USD pair fell significantly through the 1.5200 level during the week, which of course was the bottom of the ascending triangle that we had launched from last summer. At this point time, it looks like all hands of support are evaporated, and because of this I think this market continues lower...perhaps as low as the 1.50 level. Down there, I see a lot of support and resistance over the years, and as a result I think we will certainly find support in the general vicinity. Of note, the ratings agency Moody's downgraded the credit rating of the United Kingdom after the close of business on Friday. The market has not had a chance to react to this yet.