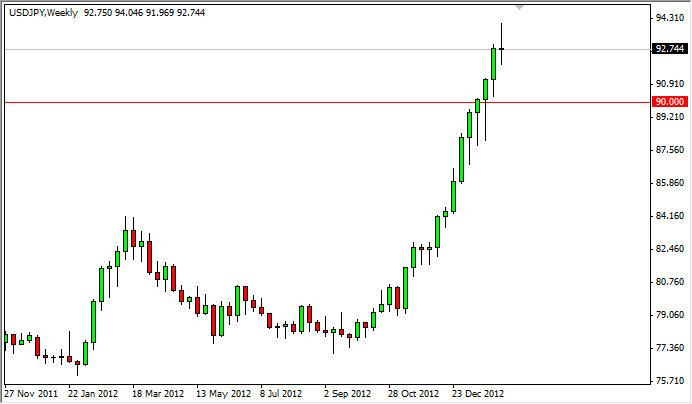

EUR/USD

The EUR/USD pair fell rather sharply during the week as the head of the European Central Bank suggested on Thursday that the high rate of the Euro was hurting the export markets for the European Union. The words spooked the markets, and the Euro sold off as a result.

The pair as a lot of minor support areas down to the 1.30 level though, and as a result I think this pair is only going to be able to fall for the short-term. Longer-term, I still expect this pair to continue higher as the ECB hasn’t actually done anything other than complain that the Americans are printing too much currency. (In a manner of speaking – besides….this isn’t exactly new!)

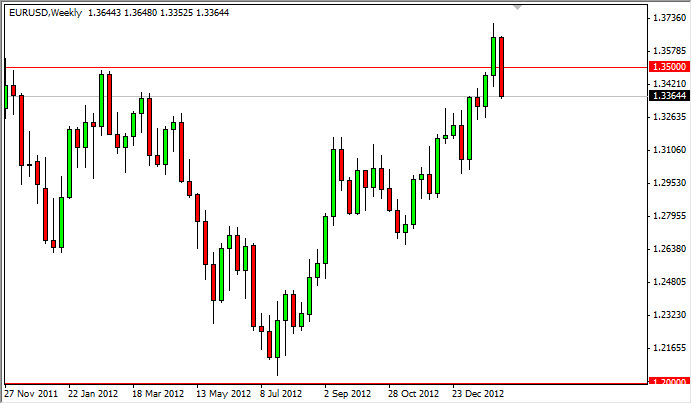

USD/CAD

The USD/CAD pair rose over the course of the last week, and is trying to break out again. This pair originally had broken above the 0.9950 level to reach 1.01, and has now pulled back and tested that area as support. At this point in time, it must be said that the support has held. The next question will be the 1.0050 – 1.01 area, and whether or not we go higher.

The pair certainly looks as if it wants to go higher, and as a result I am willing to buy this pair above the 1.01 level if we get a daily close up there. Otherwise – this pair is going to be difficult to deal with until we break down below the 0.99 handle, which would be a massive sell signal.

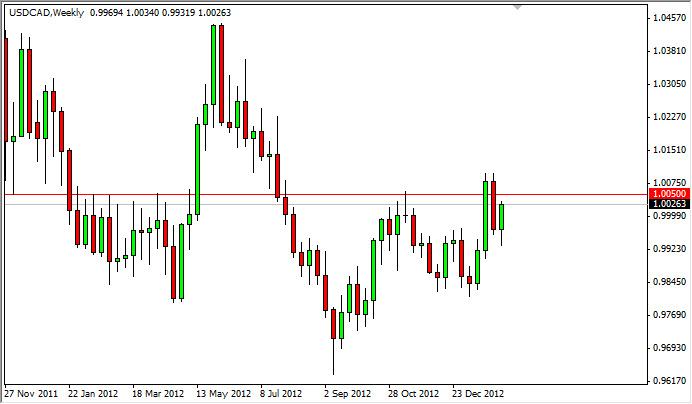

NZD/USD

The NZD/USD pair continues to grind higher overall, but lost a bit over the past week. The pair certainly looks like it is struggling with the 0.85 level, and as a result that is the area that the market needs to break above in order to get a clear buy signal. With the recent grinding higher over the last several weeks, there is no way I can sell this pair at this point as the market has been so noisy.

Looking at the continually higher lows lately, it looks to be fairly obvious to me that this pair is eventually going to break out. The area we would be breaking out of would be a larger consolidation rectangle from the 0.75 level to the 0.85 level. This measures 1,000 pips, and as a result the break out should see this pair go to 0.95 before it’s all said and done.

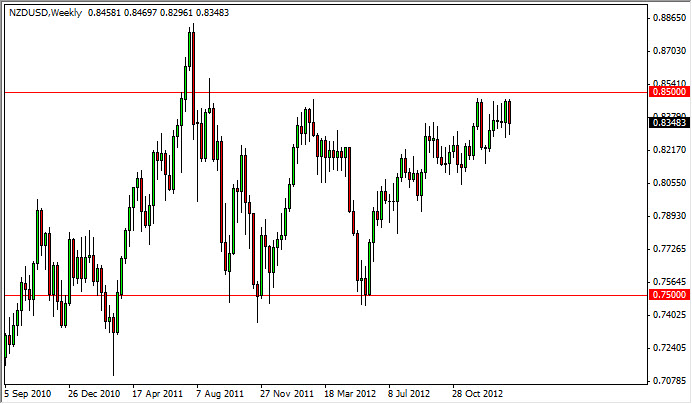

USD/JPY

The USD/JPY pair has been one of the easiest trades for weeks now. In fact, the last 14 weeks in a row have either been green or neutral. Because of this, the pair needs to pull back in a major way. The pair fell to form a shooting star over the week as the buyers finally got a bit exhausted. Truthfully, I want to buy and hold this pair, but will need to see a pullback in order to do so. The 90 level looks like the “floor” in this pair in the meantime as far as I can see.