The Euro had a huge rally the last couple of days, which was a natural result of the devaluation process that is going on in Japan, the UK, and the USA.

There are still some major issues that play along that in my opinion will cause the Euro to go down in the short-term:

- Italian and Spanish bonds fell because of a possible bailout for Cyprus and Greece is still at risk

- Italian election is around the corner on the 24th/25th of February

- Spain is still vulnerable with a + 24% unemployment rate

Al these issues will create pressure on the Euro, which in the short term could cause the ECB to react.

The trade that I'm setting up:

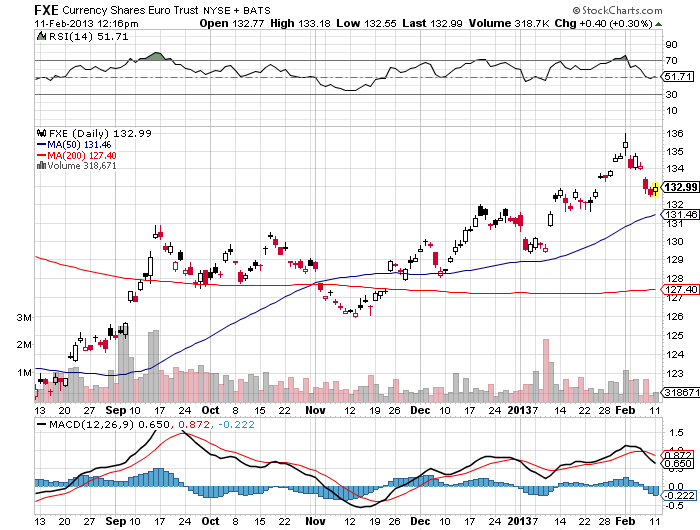

Trade: FXE

Position: 133/129 Bear Put Spread

Cost: $1.05

Risk: $105 per 1 lot

Reward: $295 per 1 lot