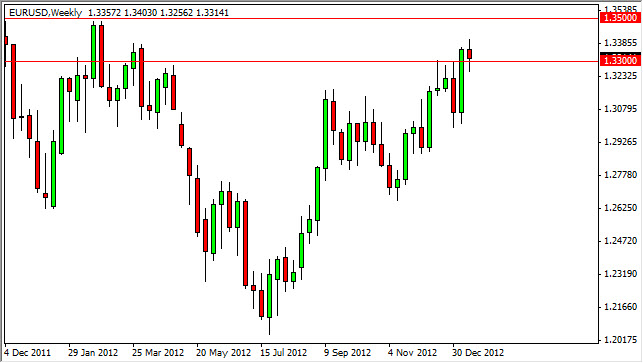

EUR/USD

EUR/USD went back and forth during the week, and finished slightly lower. However, the most important thing is that the pair can stay above the 1.3250 level in my opinion. The market is fairly bullish at the moment, but there is a TON of resistance between here and 1.35 or so. While the bulls have had their way over the last several weeks, it appears that we are taking a break at this point. In order to go higher, there will have to be some kind of catalyst. The potential one: A slew of central bank statements this week. The more bullish the markets overall, the more likely we push higher.

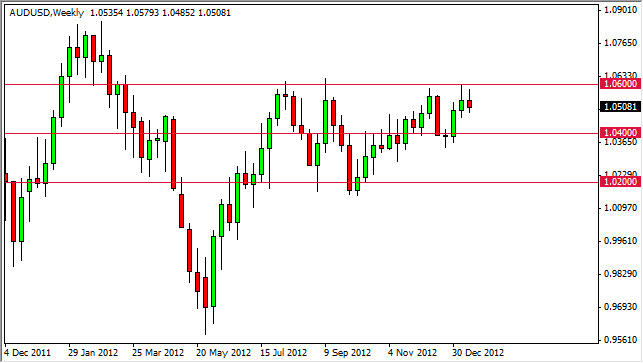

AUD/USD

This particular pair has caused a lot of heartburn for most of my Forex trading friends. With the stronger than expected economic numbers coming out of China lately, the conventional sense is that the Aussie should be climbing in value. However, this just hasn’t been the case, and a lot of people that I know are a bit perplexed. One of the main drivers: Some of the larger names in the industry are starting to openly question the validity of Chinese data. When looking at South Korean and Japanese import numbers and matching them with Chinese ones: They don’t add up.

However, I think that global easing in general should eventually push this pair higher. A break above the 1.06 is major, and should send the Aussie looking for 1.10 over the longer-term as the consolidation area between 1.02 and 1.06 suggests.

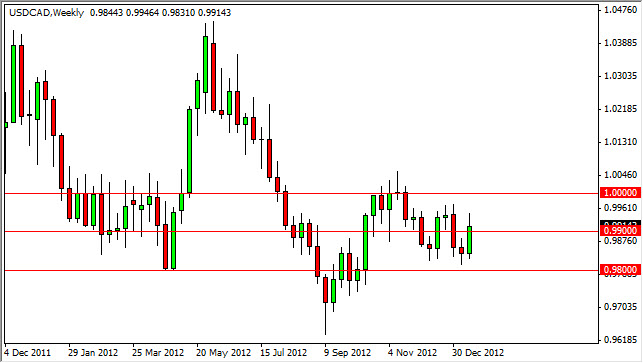

USD/CAD

If it weren’t for the Friday candle, you would have been forgiven for thinking that someone pegged the USD/CAD pair at the 0.9850 level. However, we had a move higher at the end of the week, but started to give back gains almost immediately. Paired with rising oil prices – the Light Sweet Crude market broke above the $95 level – I believe this pair is a “sell the rallies” market. However, I wouldn’t expect fireworks. I think this is simply a short-term trader’s kind of market at the moment.

GBP/USD

The GBP/USD pair had a horrific fall on Friday to make this a very ugly weekly candle. However, I see a ton of support at the 1.58 level. This area was where the ascending triangle from this last summer broke out in order to send prices higher. The break out aimed for 1.63, hit it, and we have been bouncing around ever since. Now the question is going to be whether or not we stay in this overall range. The 1.58 will be massive in its importance, and there is a good chance that we see real money make real decisions here. This week’s candle is going to determine whether or not we continue lower, or if we stay within the 1.58 to 1.63 consolidation range. I suspect the latter of the two possibilities, but do recognize that the candle closed at the very lows….never a good sign.