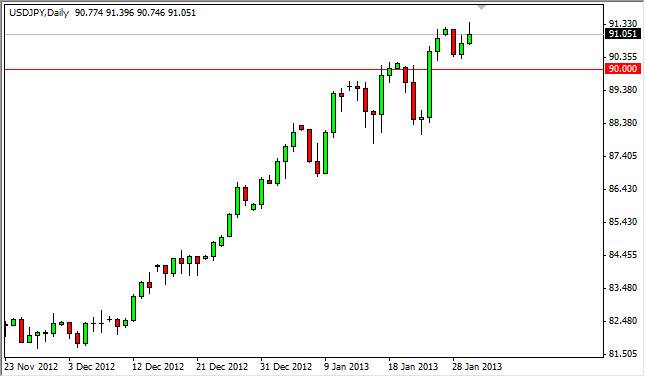

The USD/JPY pair had a positive session on Wednesday, but gave back much of the gains as we found the 91 handle to be just a bit too rich for the buyers. However, what is more telling is the fact that the candle is shooting star shaped. While I believe that the bullishness in this market will continue, when I see this type of candle just above support, it often this signals that we are about to see serious consolidation.

To see consolidation just above the 90 handle wouldn't be much of a stretch really. Also, we could even see it fall as low as the 88 handle, and still be within the tolerances of what I see as traffic. If that's the case, a pullback at this point time will simply provide one thing: a buying opportunity. After all, the Bank of Japan continues to threaten to devalue the Yen, and the entire world is starting to buy this pair.

The pause that refreshes

One of the old clichés of trading is that you will sometimes get a "pause that refreshes." This simply means that more and more buyers will stepped into the marketplace and try to drive prices higher. This is essentially because of the fact that the market sits still, and will not selloff. I believe that we are setting up for that type of move. Quite frankly, I still believe that we are going to see the 95 handle fairly soon. Also, I'm not completely the on the idea of seeing a 100 print by the end of the year.

As far as selling is concerned, I'm not interested in doing it although I do recognize that we could drop from here. Simply put, this is a one-way train that I don't want to step in front of. True, I might be aware pick up a few pips here and there shorting this pair, but I find that it's much easier to simply go with the longer-term trend when it is obvious. Because of this, I will be buying this pair every time it gets going forward.