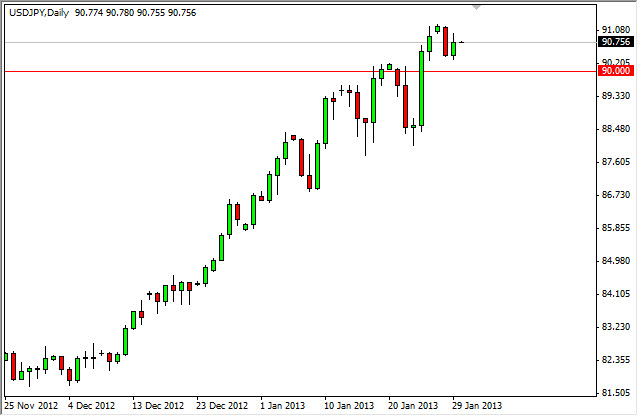

The USD/JPY pair rose during the session on Tuesday, but gave back about half of the gains by the end of the day. The candle that was formed was slightly similar to a shooting star formation, but the fact that we sit upon a massive support area at the 90 handle suggests to me that the candle shape is basically irrelevant.

I believe that this pair will continue much higher over the long-term, and as a result I am perfectly comfortable buying it anywhere in this neighborhood. In fact, the only reason that I would be hesitant is just that I could "fine tune" an entry based upon shorter time frames, but the end result is always going to be the same - I will be buying only.

This pair is currently being pushed higher by the fact that the Bank of Japan is willing to "nuke" the Yen. With the new government coming into play, it is obvious that there will be a lot of pressure on the central bank to devalue the currency, as the Japanese of fired the first shot in the next round of the so-called "currency war."

Race to the bottom

There are several central banks around the world are in a "race to the bottom" right now. By far, the Japanese are the biggest perpetrators of this currency manipulation right now. However, this isn't to say that the Federal Reserve isn't guilty of it as well. However, there are signs of economic improvement in the United States overall, and this of course will drive speculation that rates will be higher in the United States much sooner than in Japan.

Looking at this chart, I can see quite a bit of noise between here and the 87 handle, so I find it difficult to think that any pullback will be anything other than a buying opportunity at this point. In fact, I'm quite comfortable in holding onto this trade in aiming for at least the 95 handle, if not the 100 level. As for selling, I see absolutely no reason to even consider it at this point.