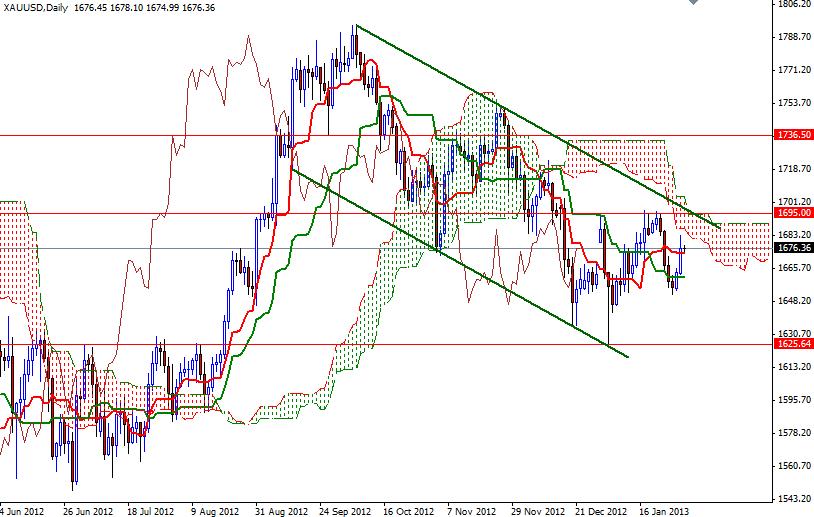

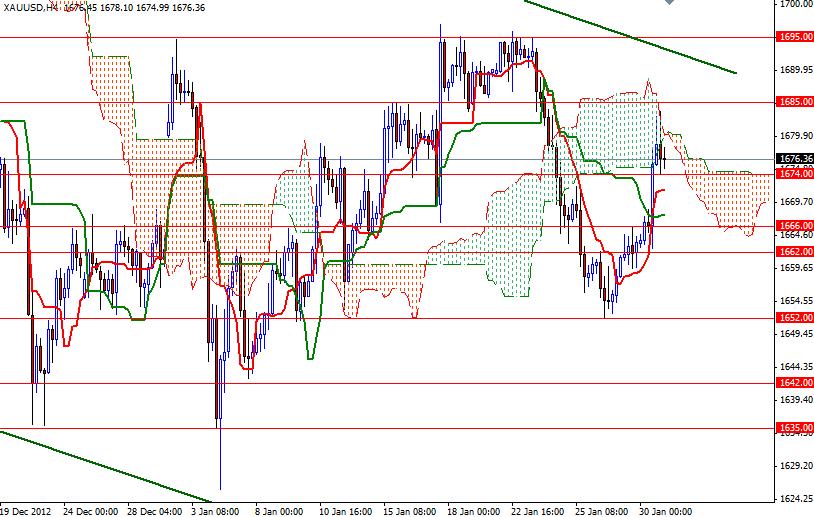

The XAU/USD pair produced a bullish candle after it pulled itself out of the bears' grip. Poor U.S. GDP numbers and expectations that the Federal Reserve will remain hyper active helped gold prices to rise sharply. Data released by the U.S. Bureau of Economic Analysis showed that the world's largest economy contracted at a 0.1% annual rate in the Q4 of 2012. The Federal Open Market Committee said “To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee will continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month” at the conclusion of a two-day meeting yesterday. It seems that the central bank has a long way to go until the unemployment rate drops below 6.5%. The Federal Reserve's easing policy (i.e. printing unlimited amounts of dollars) tends to be supportive for gold but of course demand is another crucial element shaping price movements. From a technical point of view, I think yesterday's momentum could give the bulls the strength they need to break above 1685 and retest the 1695 resistance level which caused prices to reverse several times in the past. I believe this will be a real challenge as the top of the descending channel and the Ichımoku cloud coincide at that level. We have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses on the daily and 4-hour charts.

Therefore a sustained break above 1695 would cause the charts to turn bullish. Today the key levels to the downside will be 1674 and 1666. As I think the short term direction is up, I will not consider opening a short until we are back below 1666. On its way up, there will be resistance at 1685, 1691 and 1695. Today the key levels to the downside will be 1674. If the bears take over and pull the pair below 1674, more support can be found at 1671.70, 1666 and 1662.