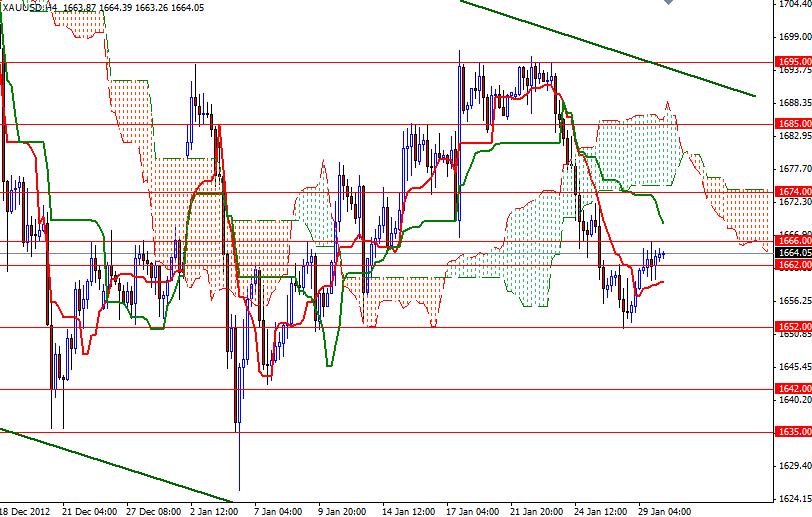

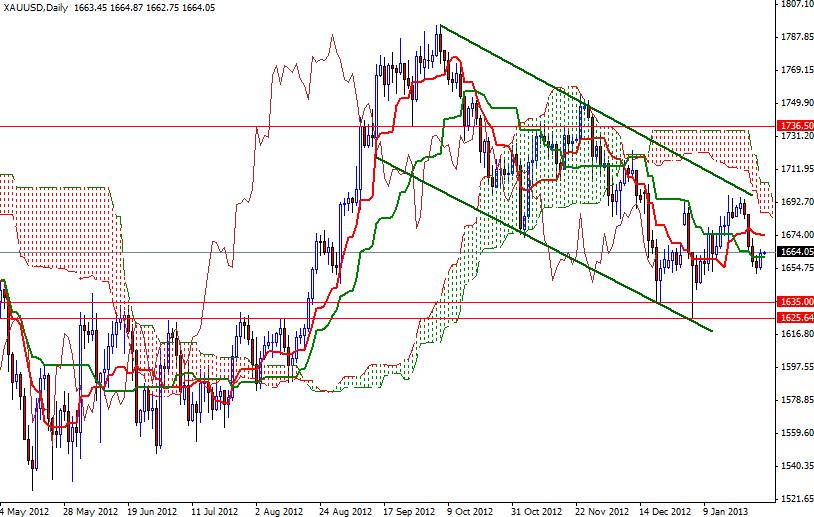

The XAU/USD pair paused its four-day decline as prices rebounded from 1652 to test the 1666 resistance level. The last few sessions saw bearish pressure due to fact that the bulls failed to penetrate a strong resistance at 1695. Yesterday's price action indicates that some market players are covering their short position prior to the Federal Open Market Committee announcement today. Disappointing consumer confidence data out of the United States was another element increasing the precious metal's appeal. Although sizable purchases by the central banks and lower interest rates seem to be gold supportive, large institutions have been betting on lower prices. Without doubt, the outcome of the FOMC meeting will be the next big market catalyst. Even though I do not expect any major changes in the U.S. central bank's easing policy, there is still a possibility that the policy makers would surprise the markets. Minutes of the FOMC’s previous meeting showed some of the voting members think it would be appropriate to end the asset purchases around mid-2013. Also bear in mind that the ADP Nonfarm Employment report and the first estimate of U.S. Gross Domestic Product (Q4) will be released today. Short term charts suggest that a retest of 1674-1675 is likely if the 1666-1668 zone is cleared. If the bulls climb above the 1675 level, which is the bottom line of the Ichimoku cloud on the 4-hour time frame, we could see another bullish attempt towards the 1685 level.

However, if the pair reverses and resumes its bearish sentiment, support can be found at 1662 and 1652. A close below the 1652 level would increase the downward pressure and take us back to 1642 and below.