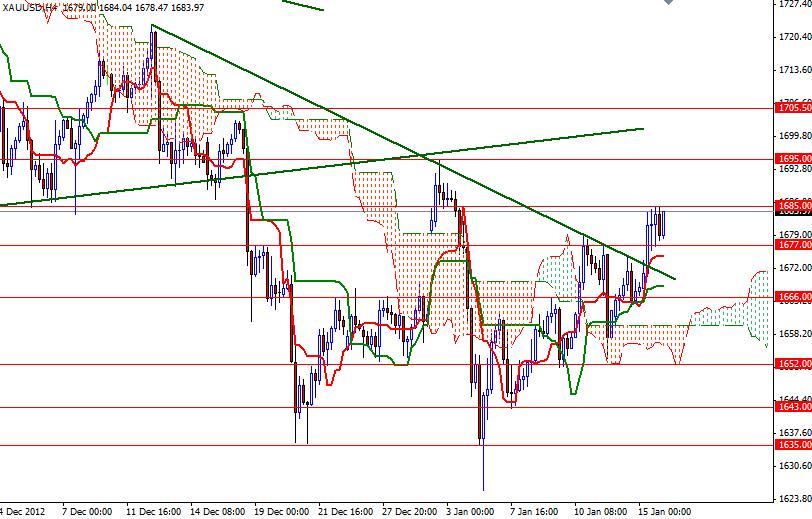

XAU/USD extended its gains as the bulls manage to clear trend line resistance at 1672.40. The pair also climbed and managed stay above the 1677 level which had been a cap on the prices recently. Gold drew strength from Fed officials’ comments on quantitative easing. Federal Reserve Bank of Boston President Eric Rosengren, who becomes a voting member of the Federal Open Market Committee this month, said the central bank wants to see substantial improvement in the labor markets so QE3 will continue into at least the end of 2013 as the recovery remains moderate. He also said the Federal Reserve could enlarge its $85 billion monthly asset purchases to hasten economic recovery. The XAU/USD pair is consolidating between 1685 and 1677 during the Asian session and I think the bulls will be dominating prices in the short term as long as we stay above the 1677 level. On the 4-hour chart, we have a bullish Tenkan-sen line (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) cross and the pair is moving above the Ichimoku cloud.

However, on the daily chart, there is a descending trend line which converges with the cloud around the 1705 level so I believe that will be a tough challenge for the bulls if we can reach there. If the bullish momentum continues and 1685 gives way, I will be look for 1695 and 1705. If prices turn bearish from here, support can be seen at 1677, 1670 and 1666.