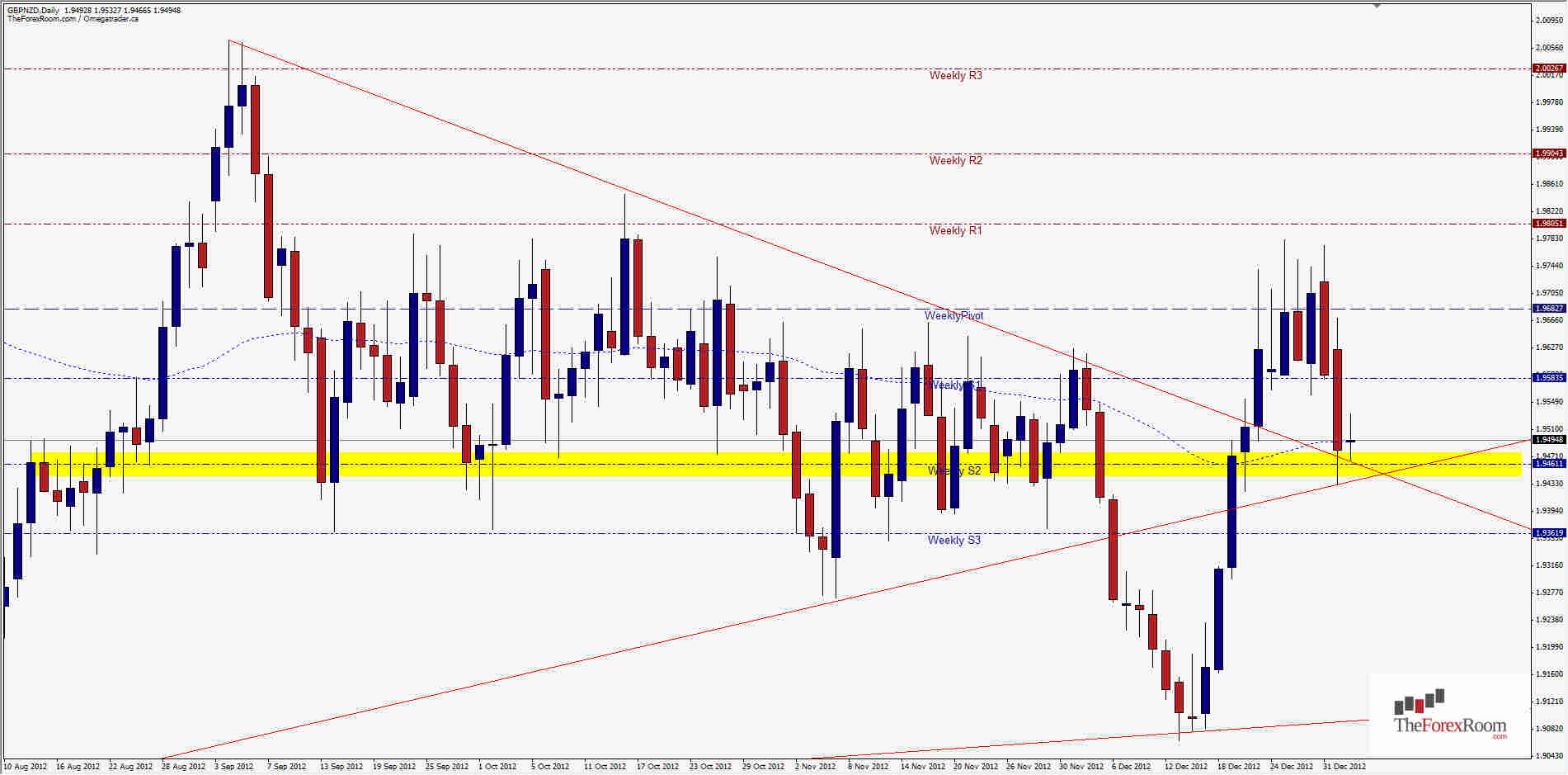

The GBP/NZD was trapped in a descending wedge since mid 2012, and an even tighter range for November 2012. We saw the pair break out to the downside on December 06, 2012 when it fell to test the long term trend-line at 1.9065 before returning to the same level that had trapped it for so long. The pair didn't stop at 1.9450 however, more of a pause than a knee jerk reaction to such a strong level of Support & Resistance, and kept right on going to make new 90 day highs just shy of 1.1.9800. Then we had another consolidation between 1.9780 and 1.9560 (the top of the November consolidation) before seeing the pair drop almost 200 pips after the markets reopened yesterday. Now the pair is right back to where it started, at around 1.9460 where support should be quite solid. We have an ascending tren-line and a descending trend-line intersecting at 1.9433. which just happens to be yesterday's low. Prices attempted to move higher in a lackluster Asian session today but are falling ever so slightly once again. Since the Kiwi is one of the stronger performers at the moment, and the Sterling is looking rather week, will we see this key level of Support hold or collapse once again? If the Kiwi continues to perform along side its cousin the thunder from down under aka AUD/USD, then the GBP/NZD is bound to take out the immediate support level. Look for a break below 1.9430 to extend the Kiwi's gains to around 1.9360 quite quickly, and then there are few hurdles to impede the fall until we reach that pesky ascending trend-line once again at around 1.9075. However, if the current level holds, look for a bullish run back up to 1.9580 and 1.9680 shortly after.

GBP/NZD Retesting Critical Support

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- GBP/NZD